The most interesting aspect of the stock market is not that one can make money by analyzing and predicting the market trends.

Instead, it's about how to use these trends to make money, because even if your predictions are extremely accurate, not making money is futile.

There are still losses in a bull market, just at a lower proportion.

Not to mention the long bear market, where losses are bound to be ubiquitous.

Have you noticed a strange phenomenon?

The stocks we once favored have produced many dark horses.

But the stocks we actually bought and held are being tormented every day.

Why is it that we can clearly see some good stocks, and from the perspective of stock selection, it seems that we should be more profitable than not, but in the actual trading results, it seems that we are more likely to lose than to make a profit, and we have not made any money.

To explain this situation, there can only be two scenarios.

First, the survivor bias.You will always pay more attention to the stocks that are rising, especially those you are optimistic about.

Whether you ultimately take action to buy this stock or not.

Whether you have ever owned this stock and finally sold it at a high price.

You will always feel that you have had an opportunity to make money, but it slipped away.

Therefore, you will always think that you can make money, even a lot of money.

But the reality is that if you are given a dark horse, you may not be able to grasp it, and even if you do, you may not be able to control it.

You seem to be able to pick stocks and predict the direction, but in fact, you cannot stand the test of data statistics.

Perhaps if you record all your judgments, you will find that your predictive ability is actually very poor.

Correct prediction is just a survivor bias, and incorrect prediction is the norm.

Second, there is a problem with the transaction itself.Predicting the direction of individual stocks and the overall market trend is merely a matter of prediction.

To make money in the stock market, one must also execute the right trades.

It may seem simple to buy low and sell high, but in reality, achieving this is extremely difficult.

Predicting that a stock will rise tomorrow, and finding a good entry point without having bought it already, is not an easy task.

Deciding whether to buy directly at the opening, or to wait for a pullback before entering, and whether to go all-in or start with a partial position, is a decision that is actually very challenging to make when the time comes.

Many people are good at theorizing, but when it comes to real combat, the probability of making trading mistakes is high.

The reason why trading is prone to problems is mainly due to the trader's mentality.

It's like trading in a simulated account, where it seems like the probability of making money is high.

But when it comes to actual trading, making money becomes very difficult because the mentality has changed.The phrase "the onlookers see most of the game" is most applicable to the stock market.

When the ups and downs have no necessary connection with your wealth, your judgment is very accurate.

But if there is a close connection, gains and losses will greatly affect your mentality, making you indecisive when making decisions.

Many investors cannot effectively make money through trading because they lack psychological quality and are prone to emotionalization.

Therefore, it is said that the mentality of investment determines fate.

It is because the mentality can affect the gains and losses of trading, and can affect the results of trading.

So, is the core of stock trading in cultivating the mind?

Perhaps many people will have this question again.

If it is a person who cultivates the Tao, this is correct.For ordinary people, the essence of stock trading lies in finding patterns and adhering to discipline.

What are some of the most correct and significant patterns in the stock market?

If you can truly understand and act accordingly, then making money and predicting price fluctuations have nothing to do with each other.

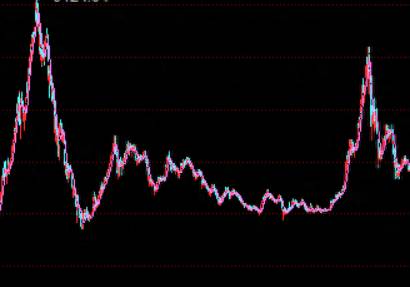

Pattern one: after a significant drop, there will be a rise, and after a significant rise, there will be a drop.

There is an inevitable pattern in the market, which is the ups and downs.

Even the most worthless stocks cannot escape this pattern, and even delisted stocks will have an increase in between.

Stocks are a trading market, focusing on the game, and cannot be completely regarded as an investment.

If you look at the long-term perspective of stocks, there can be investment value, directly through the short cycle.

But for the process of ups and downs, it is inevitable, it is the law of the cycle, it is an iron law.

So, don't be afraid when it falls, especially in the later stage of the decline, the drop has been very deep, there is no need to panic.Do not cut your losses on the floor, and at the same time, there is no need to envy those that have soared, because they will fall back sooner or later.

So many big bull stocks, after peaking, are cut in half or even worse, which is the best proof.

Rule number two, the first thing that makes money is always to speculate on hot spots.

Capital is the father, and everything else is just a younger brother.

In any era, it is an era of speculating on hot spots, which is a rule in the stock market.

Performance is not neglected, but it is treated as another topic for speculation.

What the market wants is the space for imagination, which is essentially telling stories.

The story of performance can be told today, tomorrow, and every day, so it is not told every day.

The story of the topic, the story of the hot spot, is a story of a certain stage, and can only be speculated on at the moment.

This is the law of the market. You can make money without relying on this law, but do not always fight with the market, thinking that speculating on hot spots has no value.Capital is profit-driven, not performance-chasing. Where there is a money-making effect, capital will flow there.

Rule three: It's better to wait until you see the rabbit before releasing the hawk.

The essence of making money is to see and then do it, not to rely on advance prediction.

The majority of capital makes money by following, not by controlling the market.

Especially for ordinary retail investors, when they cannot control the market, they should reduce the practice of lying in wait.

Lying in wait means not knowing when you can make money, when it will rise, and it may be far away.

The market only provides two answers: rise and fall. Lying in wait means the fall is greater than the rise, while following means the rise is greater than the fall.

Releasing the hawk in the air before seeing the rabbit means that many times the work done is futile.

Retail investors are not the main force. It takes a long time to lay out, and it is completely possible to see it, execute it in the first time, and follow quickly without missing too much.

Chasing the rise is not a bad thing. The key is whether the point of chasing the rise is early enough, and you can get on the train as soon as you find it.Rule Four: Swing trading is an important way for ordinary people to make money in investments.

Ordinary investors should never think they can catch the bottom and escape the top of the market.

Don't always fantasize about buying a big bull stock for a few dollars and then selling it after it has increased by 10 times.

These are actually not very realistic.

Most of the people who make money are those who honestly do high selling and low buying, and those who are down-to-earth in swing trading.

Those who speculate on hot stocks and demon stocks are just looking at the excitement, and the actual money made is relatively limited.

The trading mode of licking blood on the knife edge has not actually made a lot of money in the true sense, and it is not suitable for ordinary investors.

Ordinary retail investors, by accumulating profits from high selling and low buying, and by making big profits and small losses, increase their capital, which is the right way.

So, in the trading process, being able to lock in part of the profit during the rise is the top priority.

This is not the law of the market, but the law of making money for ordinary retail investors. If you can follow it, you can significantly increase the probability of making a profit.Making money from stock trading is not solely dependent on prediction, but rather on the trading itself, the trading mentality, the position-holding mentality, stock selection ability, and so on.

The profit and loss of stock trading is a reflection of comprehensive cognitive and execution abilities, which is complex yet simple at the same time.

Comments