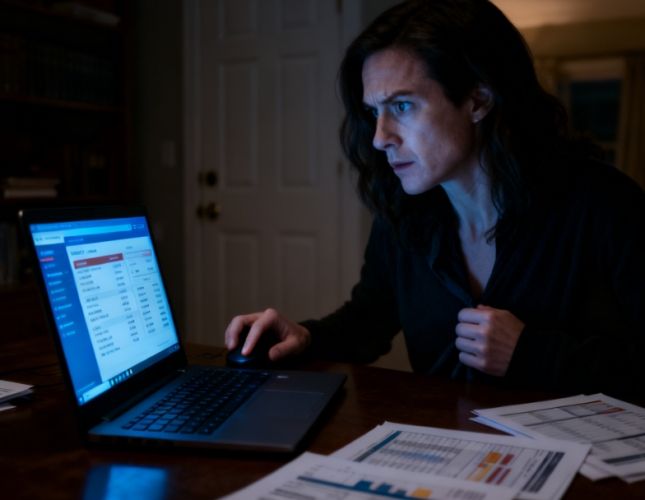

The bear market that began on February 18, 2021, when it will end, remains unknown.

For this round of bear market, let's summarize some insights.

1. In a market with limited liquidity, one must be good at waiting for opportunities.

After 2021, the market no longer had an increase, it was all about existing capital.

On one hand, the valuations that were being traded at the time were indeed high, and capital was unwilling to enter.

On the other hand, public mutual funds began to collapse, with no new capital, but instead a large amount of redemptions.

Combined with some overseas changes in the past two years, some funds were withdrawn to be allocated to overseas markets, the entire market was actually very short of money.

A market short of money has a characteristic, that is, most of the time is junk time, with more falls than rises.

Because of the shortage of money, capital needs cheaper chips and more cut-loss positions.Following this logic to observe the market, like a cheetah, waiting for the decline to end before entering to hunt is the most suitable approach.

2. Structural hot spots can be participated in, while non-hot spots should be avoided.

In a bear market, there is less money, and opportunities are fewer, but there will always be opportunities.

A characteristic of a bear market is the potential for huge profits, which are often the hot spots, and these are often magnified.

Because capital wants to make money, and it has been suppressed for a long time, it needs an emotional release.

When capital caught onto AI, it speculated on AI from top to bottom, whether it was chips, communication, servers, or media, games, robots, starting from the large models, it was wildly speculated.

Because capital needs to find structural hot spots as its way out.

But it is obvious that stocks that are not on the hot spots, like pigs not in the wind, often cannot take off and will continue to decline.

From AI to Huawei, it is actually the same, finding an outlet for a hot spot, and then wildly speculating.

In a bear market, only participating in hot spots and not touching non-hot spots is a good way, at least the chances of winning will be significantly higher.3. High dividend direction is the main direction for risk aversion in a bear market.

After a year of bear market, the most certain direction turns out to be high dividends.

Although the increase is not very large, the CSI Dividend Index still has 6%, compared with the index falling nearly 4%, it has achieved a 10% excess return.

If compared with the Shenzhen Composite Index and the ChiNext, the gap is even greater.

Originally, in a bear market, the main direction for risk aversion was consumption and medicine, but this bear market is not the same, it is a bear market with negative CPI growth, and consumption and medicine can't hold on either.

On the contrary, bank stocks with a dividend rate of more than 5% have been strongly sought after by the market.

Agricultural Bank of China and Bank of China both rose by more than 30% annually, Construction Bank by 24%, and the weakest Industrial and Commercial Bank of China also has 18%.

High dividend individual stocks are undoubtedly the must-kill weapon to outperform the index in a bear market.

Of course, when the market turns from bear to bull, the performance of these high dividend individual stocks may not look good.

4. Do not participate in the stocks that are heavily held by funds and have not fallen deeply.The stocks heavily held by funds have become the heaviest hit in this bear market.

Starting with a 50% drop, and even 70%, 80% are everywhere.

It's not that they are not cheap, but the funds have no money to buy at the bottom and are facing a large area of redemption, which is a very big vicious cycle.

In the absence of market intervention, this situation is difficult to completely reverse, that is, the cycle will continue.

For funds, the stocks that have fallen a lot, if they are obviously lower than the value, are reluctant to cut their losses.

And those that are halfway up the mountain, some overvalued ones, are easy to become the target of slaughter.

Those stocks that are heavily held by funds and are still halfway up the mountain are actually the most risky.

Upward, a 30-50% increase is the top, with huge pressure, and there is still a lot of room to fall, once it falls, it is bottomless.

From 2021 to 2024, these stocks have gone through such a process in three years, and the bottom is still not clear.

5. Do not participate in stocks that have been hyped up and have a peak in trading volume.Besides the stocks heavily held by funds, those that have been maliciously hyped by capital also have a very slim chance.

After reviewing all the individual stocks that were wildly speculated in 2023, those leading stocks and "demon stocks," once they start to shrink in volume, almost all of them are in a downtrend.

Many stocks accumulate a large amount of trading volume, and then trap a group of retail investors at the top of the mountain.

In addition, if the market environment is very poor, there are also a lot of stocks that are being "killed" by A-share investors.

Once a peak in the distribution of chips and the peak price appears, the market for these stocks in a bear market is over.

Do not take over high positions of stocks with high risk, poor performance, no expectations, and only speculative emotions.

6. Position control is key, a position of 30% is the most secure.

It is very important to control the position in a bear market.

So far in this big bear market, the time points of losing money all have a relatively high position, exceeding 70%.

The time points of making money actually have a relatively low position, all below 30%.The article translates to:

It's not about making money with just 30%, but rather having a 30% position and then seizing opportunities to increase the position, and then making money.

When 70% of the position is retained, it is usually at a high level, which is very passive, and the pressure is also particularly great.

In a bear market, the emphasis is on mobility and flexibility, not on being fully invested and bullish, otherwise, you will lose everything.

From a safety perspective, it is best not to hold more than 30% of the long-term stock position, but try not to be empty-handed.

People who are empty-handed have too extreme a mentality and will often miss some good opportunities because they have a subjectively bearish view.

Flexible allocation of positions makes it easier to grasp the phased opportunities in a bear market, and it is easier to take profits when the time is right.

7. Give up the mentality of bottom-fishing and find opportunities in panic.

The experience of a bear market tells us that bottom-fishing is something that should never be done, it's not something ordinary people can do.

Bottom-fishing will only leave people bruised and battered.

Can you buy stocks during the decline?In fact, it is possible, that is, by taking advantage of the panic, when there is a sharp decline.

Especially after a continuous decline, when the decline suddenly accelerates, there is an opportunity.

As for the long-term slow decline, do not blindly bottom-fish, the market risk is very high.

In the panic, the game is actually quite large, because the panic comes out of the flesh-cutting plate, the main force needs to digest.

The way to digest is to make a rebound, and then sell this part of the chips again.

That is, the main force's way of operating is to deliberately create panic, and then fish for chips from the panic, and then do more.

When the super-sold is out of line, the small and medium investors' emotions collapse easily, and they throw chips, and when they are given hope, they are easy to buy in large quantities, which is just right.

8, do not be swayed by the news, look at the market rationally and calmly.

The market is in a bear market, there are too many news.

There are bullish, bearish, official, self-media, foreign media, overwhelming.

In fact, it is feasible, which is to seize the moment during the panic, when there is a significant downturn.

Especially after a continuous decline, when the drop suddenly speeds up, there is an opportunity.

As for the prolonged gradual decline, do not blindly try to catch the bottom, as the market risk is extremely high.

The opportunity is actually quite substantial amidst panic, because panic leads to selling at a loss, which the main force needs to digest.

The method of digestion is to create a rebound and then sell off these shares.

That is, the main force's operation strategy is to deliberately create panic, and then seize the shares from the panic and turn around to go long.

When the market is oversold, retail investors' emotions collapse easily, leading them to sell off their shares, and when they are given hope, they are prone to buy back in large quantities, which fits perfectly into the main force's plan.

8. Do not be swayed by news, observe the market with rationality and calmness.

In a bear market, there is an overwhelming amount of news.

There are bullish views, bearish views, official statements, self-media reports, foreign media reports, all pervasive.In fact, these pieces of news ultimately cannot point to the rise and fall of the index; they are all ineffective information. They only stir up the emotions of investors, offering hope one moment and despair the next, causing a mix of sorrow and joy within.

It is best to view the market rationally and calmly, by excluding all influencing news, even if it is positive. Everything will be reflected and explained on the trading board.

The premise of being objective is to be devoid of emotions, and the premise of being rational is to avoid making subjective judgments.

Retail investors are overly hopeful for stock prices to rise, so many policies and news are over-interpreted. In reality, when a piece of news is known to everyone, it has already become ineffective.

9. Objectively view the technology and experience the market sentiment more. To make money in a bear market, one needs to rely on some technical skills, but not over-rely on them. Because in a bear market, many technical indicators fail to work.In a bear market, emotions are crucial because opportunities to make money lie within emotions themselves.

The recent reversals have essentially been driven by extremely pessimistic sentiments, leading the market to make a desperate counterattack.

Emotion represents the selling of a large number of retail investors, and opportunities arise.

The technology is completely different in a bear market compared to a bull market.

In a bull market, you don't actually need technology, because the probability of making money by holding stocks is the highest.

In a bear market, you need to bottom-fish, which is the ability to seize opportunities when stocks are oversold, and you also need to escape the top, which is to effectively take profits when the time is right.

However, when the market goes crazy and emotions take the lead, technology becomes ineffective.

At this point, it's about how to arrange emotions, how to confront emotions, and to operate in the opposite direction.

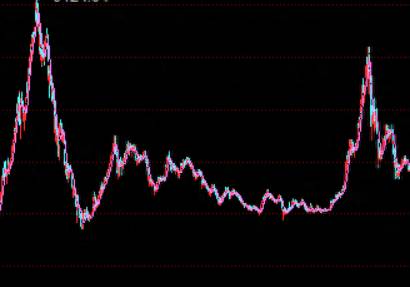

10. Do not be overly pessimistic, good opportunities are created by falls.

I always believe that in this market, only those who remain optimistic can make a lot of money.Optimism in mindset does not mean that one should always operate with a full position in trading.

In trading, it is still necessary to maintain a cautious and reverent attitude, as the market has repeatedly slapped everyone in the face.

However, there are opportunities in a bear market, and opportunities are created by declines.

There are opportunities in March to May, July to August, and September to November, but they are all minor opportunities.

Excessive pessimism means missing many opportunities, whether it is AI, Huawei, or various other things.

Moreover, the pessimism at 3300 continued to 2700, which makes no sense, after all, the index has released 20% of the risk, and the market risk has obviously decreased.

It is said that one should be optimistic when the market falls too much and cautious when it rises too much, which is absolutely correct.

If the market does not come, then wait more, the market will always rise after falling too much, and the market will always return to 3000, right?

What needs to be done now is to try to protect your principal as much as possible, do not arbitrarily bottom fishing, chasing rises and killing falls.

As long as the green mountains are there, there is no fear of no firewood to burn.Of course, those who are already deeply entangled might as well be patient and wait; there is no need to cut losses at this position.

Since the market has already shown some signs, just wait until it rebounds to 3000, and then make plans.

Comments