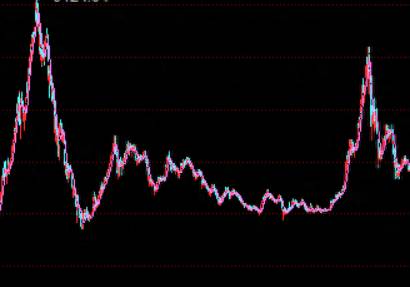

"The banner on the city wall changes with the king" is a true portrayal of the annual competition for the performance championship among public mutual funds.

This year's competition for the championship of public mutual funds is even more fierce, with a "great reversal" on the last day! December 29th is the last trading day of A-shares in 2023, before which Zhou Siyue has been sitting on the throne of the champion.

The vigorous market of the Beijing Stock Exchange in the fourth quarter helped Gu Xunfeng, who was fully invested in the Beijing Stock Exchange, to "overtake on the bend" in the last two months and win the annual championship.

However, there are exceptions, such as the Changsheng Shengyu Pure Bond Fund under Changsheng Fund. According to the "Morningstar Morningstar China Fund Performance Ranking List", as of December 31, 2023, the fund won the championship of credit bond products in the past three years. This is another championship won by Changsheng Shengyu Pure Bond after winning the annual performance championship of similar products in 2021 and 2022, leading the performance of similar products in the three-year period, proving that the product performance is continuously online.

Looking at the Morningstar list in detail, as of December 31, 2023, Changsheng Shengyu Pure Bond Fund ranked 1/217 in the performance list of credit bond products in the past three years, with an annualized return of 7.00% and a maximum drawdown of 0.65%.

Among the top 10 products on the list, only Changsheng Shengyu Pure Bond has an annualized return of over 7%, and other products are all below 5.7%. This means that for the "meticulous" bond fund investment, the accumulation of every bit has opened up a gap with the industry peers. Looking back at the drawdown, the maximum drawdown of the other 9 products is all over 1%. Overall, "rising more and falling less" may be the direct reason for Changsheng Shengyu Pure Bond to win the championship.

Changsheng Shengyu Pure Bond Fund is independently managed by the "fixed income investment drawing school" fund manager Wang Guijun, and another excellent pure bond fund under Changsheng Fund - Changsheng An Yi Pure Bond is still independently managed by Wang Guijun.

According to the Morningstar list, as of December 31, 2023, Changsheng An Yi Pure Bond won the championship of pure bond type products in the past three years, with a specific ranking of 1/319, an annualized return of 6.18%, and a maximum drawdown of 0.91%.

Among the top 10 products on the list, only Changsheng An Yi Pure Bond has an annualized return of over 6%, and other products are all below 5.7%; looking at the maximum drawdown of the products, only two products including Changsheng An Yi Pure Bond have a maximum drawdown within 1%.Reviewing the quarterly reports of the aforementioned two funds for the year 2023, it can be observed that their outstanding performance stems from fund manager Wang Guijun's forward-looking market layout and flexible grasp of investment opportunities in different types of bonds. Wang Guijun's investment holdings can be summarized as a "1+N" strategy, where "1" refers to the main body of investment in AAA-rated credit bonds, with strict control over credit downgrades; "+N" refers to the fund manager's combination of market conditions, and based on relatively clear investment opportunities, participation in swing trading through operations such as interest rate bonds to increase returns; additionally, the fund manager will flexibly adjust the leverage level according to market conditions. Taking Changsheng Shengyu as an example, during the first quarter when the market trend was not clear, and during the third quarter when the bond market rebounded, the bond holding ratio of Changsheng Shengyu was lower than the industry average. However, against the backdrop of a clear bull market in bonds in the second quarter, the proportion of bond holdings to net asset value has increased to 132.98%.

Against the backdrop of significant fluctuations in the equity market in the past two years, Changsheng Shengyu Pure Bond and Changsheng An Yi Pure Bond have been "discovered" by many investors based on their outstanding performance.

According to the fund's regular reports, the number of holders of Changsheng Shengyu Pure Bond Fund increased from 14,300 at the beginning of 2023 to 159,200 in the middle of the year, an increase of more than ten times in half a year. During the period from 2020 to 2023, the share of Changsheng An Yi Pure Bond Fund increased significantly, and the total scale of the product exceeded 800 million shares by the end of the third quarter of 2023.

Changsheng Fund's fixed income investment layout is not limited to pure bond funds. It is understood that in recent years, Changsheng Fund has been firmly oriented towards absolute returns in fixed income business, continuously enriching the system of absolute return products.

Galaxy data shows that in 2023, when the return rates of stock and hybrid funds both suffered losses of more than 9%, 17 bond funds under Changsheng Fund (calculated separately for A/C/D/E) achieved an annual return of more than 4%. In addition, according to the "Haitong Securities - Fund Company Fixed Income Asset Classification Scoring Ranking List", as of December 29, 2023, the standard score of Changsheng Fund's fixed income assets in the past three years was 2.05, ranking first among 132 peers.

Risk warning: Funds carry risks, and investment requires caution. Funds are different from fixed-income expectation financial instruments such as bank savings and bonds, and the risk-return situation of different types of funds varies. Investors may not only share the returns generated by fund investments but also bear the losses brought by fund investments. The fund manager reminds investors to carefully read the "Fund Contract", "Fund Prospectus", and fund product material summary and other product legal documents. On the basis of understanding the product situation and sales appropriateness opinions, make rational judgments and cautious investment decisions. The fund manager promises to manage and use the fund assets with the principles of honesty and credit, diligence and responsibility, but does not guarantee that this fund will definitely make a profit, nor does it guarantee the minimum return. The past performance and net value of this fund do not predict its future performance, and the performance of other funds managed by the fund manager does not constitute a guarantee for the performance of this fund. Changsheng Fund reminds you of the "buyer bears the risk" principle of fund investment. After making investment decisions, the investment risks caused by the changes in the fund's operating conditions and net value are borne by you. The fund manager, fund custodian, fund sales institutions, and related institutions do not make any commitments or guarantees for fund investment returns.

Comments