Many retail investors actually know that stock trading requires following the main trend.

But what exactly is the main trend, and how to grasp it, is often a mystery.

One moment this stock is soaring, the next that one is skyrocketing, chasing after gains everywhere, only to find oneself becoming the perfect "bag-holder".

It is said that every round of market movement has a main trend, so what exactly is the main trend, and how to grasp it.

Today, let's talk about the skills of seizing the main trend, as well as the subtle clues in the market.

First, think about a question.

What is the difference between the main trend and hot spots?

The conclusion is actually very simple.

The heat of hot spots can be long or short, and it does not necessarily run through the entire round of market movement.

The main trend often runs through a whole round of market movement, and even during the adjustment period of the market, it shows strong momentum, repeatedly setting new highs.At the same time, the market will exhibit various cyclical minor fluctuations, and the main trend may also change and be passed on at times. That is to say, the main force of capital is very likely to define different main trends at different stages. Treat the small market cycle as a phased main trend cycle. Some people refer to it as hot spot rotation, and some people refer to it as sector rotation; in fact, they all mean the same thing. But in reality, for a major cycle market (more than 3 months), there is usually only one true main trend. Not every casual rise is called the main trend. Many are sub-trend rotations within the main trend, or what can be referred to as hot spot rotations.

For example, under the broad technology theme, there are sub-trends such as information technology innovation, artificial intelligence, robotics, smart cars, 5G, and big data, all of which fall under the main trend of big technology.

Similarly, under the broad medical theme, there are sub-trends such as traditional Chinese medicine, pharmaceuticals, bio-pharmaceuticals, innovative drugs, medical aesthetics, and medical equipment, all of which fall under the main trend of big healthcare.

And under the broad financial theme, there are sub-trends such as banking, insurance, securities, non-bank finance, trusts, and financial technology, all of which fall under the main trend of big finance.Under the main storyline, there are many branch lines hidden, and the rotation of these branch lines can also be regarded as a small main line.

The real main line must have the following two points.

1. The sector is large enough to accommodate a lot of capital.

The so-called main line must not be a small hot spot, it must be large enough.

If a hot spot only corresponds to a dozen stocks, and the total market value is not more than 100 billion, it is absolutely impossible to become a real main line.

Because the market value of 100 billion corresponds to a circulation plate of 10 billion, which is not enough for the main force to divide.

The main force can't get the chips, how can it be speculated, and how can it become the main line?

Only speculators can play this kind of volume of hot topics, a one-time speculation of the market, looking for a take-over.

Generally speaking, the main line sectors are all starting from a trillion level, and even can reach a market value of more than 100 trillion.

That is to say, the sum of all branches of the main line accounts for at least more than 15% of the entire market, which can be called a real main line, breeding a big market.Otherwise, smaller hot spot plates find it difficult to sustain speculation, as major main force funds cannot participate.

2. Meet the needs of the current era and policies.

To become the main line, there is also a very necessary condition, which is to conform to the era.

From a macro perspective, it is necessary to have the support of policy dividends, that is, policy orientation.

The industry must form a certain trend effect under the warm policy, and there will be a continuous influx of funds to join the speculation.

The main force funds must have a bottom in their hearts, whether there will be someone to take over the plate is the key.

Here, the plate-taking is not necessarily aimed at retail investors, but the attention of various large funds to the track and the willingness to enter the game later.

Secondly, the main line is often a product of the era, and it cannot be supported by policies alone.

Just like new energy vehicles, relying solely on government subsidies cannot drive the rapid development of the industry chain, and the same is true for photovoltaics.

But if the era's wind is blowing, and the demand side has already exploded on the supply and demand side, then the entire industry chain will take off, and the main line will emerge.The main threads of each era have distinct characteristics, whether it is the earliest real estate, big finance, to resource-based non-ferrous metals, to state-owned enterprise reform, and then to various technology industries, and the upgrading of big consumption, etc.

Bull markets have main threads, and bear markets actually have main threads as well, but the main threads of bear markets will be carried out in rebounds, and the cycle will be shorter, while bull markets will run through from beginning to end.

Finding the main thread is the foundation for investors to achieve "low risk, high return", because the main thread is where the money is most abundant, and the opportunities to make money are naturally the most abundant.

How to find the main thread, what are the clues?

It's easy to talk about the main thread, but it seems not so easy to find it.

When everyone is shouting about the main thread, at least the main thread has already reached the middle and later stages.

The main thread is often quickly speculated as a hot spot in the early stage, and the first half of the rise will be consumed in the short term.

And the latter half of the rise is mainly the main force of the capital market to take over the baton, and to make the main thread a new height.

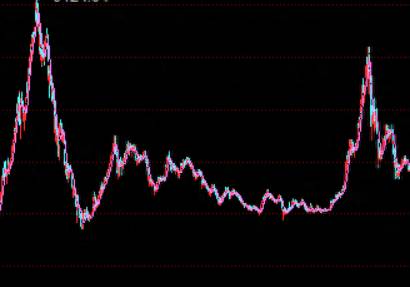

Therefore, there are different signs in the two stages of the main thread, and give everyone some of the most understandable main thread standards.Phase One: Broad Market Uptrend.

A broad market uptrend refers to the widespread rise in the entire sector. For instance, if a sector consists of 100 listed companies, and 90 of them experience an increase, this is known as a broad market uptrend. Within a broad market uptrend, if more than 5% of the stocks hit their upper price limit, it signifies the characteristics of a main trend. This is because the main trend is always fiercely sought after by capital, and hitting the upper price limit is a hallmark of this.

A main trend does not have lagging stocks, nor does it have a single leading stock; it often presents a situation where a hundred flowers bloom together. As previously mentioned, a main trend sector usually has a considerable capacity to accommodate funds. A large-volume sector experiencing a large-scale price limit hit and a broad market uptrend is a very standard signal. In the first phase, the uptrend needs to have a certain degree of continuity, generally with a continuous increase for three days as a standard signal.

Phase Two: Large-cap Stock Uptrend.

In the first phase, the pioneers are often small-cap stocks, and it is rare for large-cap stocks to rise rapidly.When it comes to the second phase of the main line, the big tickets will start to kick in.

The launch of big tickets signifies the entry of large capital, setting up a larger game.

Large capital would not dare to enter the market to speculate on a single stock without a volume of several billion, because there are not enough shares available.

When this sector sees the entry of large capital, it represents an upgrade of the players.

Large capital does not operate as violently as speculative capital, but it is more stable and will operate over a longer cycle, with the space not being too small.

If the big tickets concentrate on volume, it indicates that the entire main line has been firmly established and will embark on a second round of growth.

Generally speaking, the ultimate buyers of big tickets are mainly public funds, and the stocks they speculate on are all core concept stocks, with certain performance expectations, becoming the final main line.

The main line also has a distinct feature, which is to have room for growth, at least calculated in multiples.

If there is only a 30% growth space, it is not called the main line, at most it is a concentrated repair market.

The foundation of investment is cognition, and the cognition of the main line is the basis for making money in the market, and it is also the key to outperforming the overall market.The era of universal benefits has long passed. The future is a time of structural market conditions, an era that requires the ability to grasp the main line.

Comments