The number of middle-aged people investing in stocks around us has indeed increased over the past two years.

Those in their 30s, 40s, and 50s are entering the stock market, and many are doing so during a bear market.

Among them, the proportion of people in their 40s entering the market is the highest.

On the contrary, those in the 20-30 age group hardly play with stocks at all.

It is said that at forty, one is no longer confused.

Entering the stock market is like entering the most brutal arena at the most confused age.

I define this path as a road of no return.

The road of no return does not mean that it will definitely fail, but it means that there is no way to return to the starting point.

When a person no longer moves forward on their original first growth curve and instead attempts to switch to the investment track, it is actually very difficult to switch back.

On the one hand, their enthusiasm for work will plummet, making it difficult to achieve a real breakthrough in their work.On the other hand, the way of making money by lying down, such as stock trading, is hard to let people return to the track of making money by selling time.

Although not all, at least more than half of the stock investors cannot completely say goodbye to the stock market.

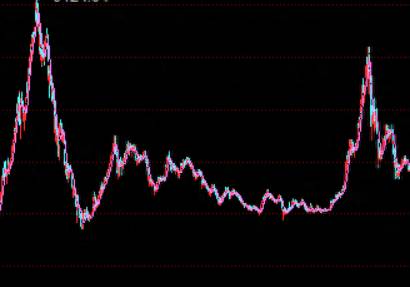

Even in the long bear market, they become one dormant account after another, and when the bull market comes, they will still be quickly activated.

Stock trading can secrete dopamine, and the rise of stocks will make people feel happy.

Of course, the decline of stocks will also make people feel disappointed and helpless.

The stock market is another place that can mobilize emotions, and it is a reflection of the psychological world of many people.

In the world of capital, or in the world of transactions, it is easy to lose oneself and lose direction.

Are you really ready to go to stock trading when you are middle-aged and frustrated?

The vast majority of people do not know what they are facing in stock trading.They only know that investing in stocks involves certain risks, such as a loss of 20-30%, or perhaps more seriously, a loss of 50%.

Of course, they may have also heard of people jumping off buildings due to stock trading.

Many people tend to downplay the risks before entering the market, not knowing whether they think they are capable or believe that such unfortunate events will not happen to them; in any case, they remain quite calm.

But when they actually immerse themselves in the market, their mentality begins to fluctuate.

You think you can withstand a -10% loss, but when a 10% drop occurs in a single day, you find it very distressing.

Even when the stock rises and then falls, you will start to regret why you didn't sell at a high point.

The various trials of human nature begin to intertwine, and the risks and returns of stock trading, which were originally lightly described, will be infinitely magnified.

A small portion of middle-aged people with rich life experiences can see through the emotions in the stock market.

But the vast majority of people, in the end, still follow their emotions and human nature, busying themselves in the stock market, yet still incurring losses.

You should understand that when your expectation is to find a new track to make money, but the outcome is to lose your principal, it is very painful, and the gap will be very large.If you want to understand a question, you will find that everything is very natural.

Although you are approaching middle age and know nothing about the stock market, why can you make money in the stock market?

Everyone knows that the number of people who make money in the stock market is a minority. Why are you one of the minority? Where are you better than others? You need to think about this clearly.

If it is summarized in the result, there are at most three points.

First, it is strong in the mentality.

Mentality is actually very easy to understand.

Stock trading requires mentality as the underlying support.

Some middle-aged people have experienced ups and downs and have a better grasp of the mentality of trading.

They have experienced the ups and downs of life, and naturally, they are not surprised by the ups and downs in the stock market.

If you can adjust your mentality properly, it means that at least you are stronger than 80% of investors, and the probability of making money is higher.The mindset requires honing, which varies from person to person.

People who have experienced setbacks may have more opportunities in the stock market.

Secondly, it's about the strength of the principal.

Some middle-aged people, in terms of the initial accumulation of principal, will do better.

The capital market depends on the investment principal.

For example, when the stock market continues to fall, some people have no money to replenish their positions.

But some have a lot of funds to go bottom-fishing.

The outcomes of the two are naturally different, and of course, the more principal you have, the greater the chance of turning things around.

In addition, large capital often has lower requirements for the rate of return on investment, and can adopt more strategies.

Small capital is often more eager to double, so the requirements for the principal are naturally higher.Thirdly, strength lies in experience.

The so-called experience is not necessarily experience in stock trading, it could be other types of experience, such as industry experience.

Some people may be more familiar with certain industries and have their own unique insights.

Being able to select industries, companies, or business models that they understand can help them gain a certain advantage in investment.

Of course, the stock market itself is a "small society", and its operation rules also conform to human nature, cycles, and the logic of all operations.

The deeper the experience and the richer the experience, the easier it is for people to make money in the stock market.

Of course, this "easier" is not as simple as people imagine, but the probability will be higher.

If you find that you don't have these three points, then entering the stock market is actually starting from kindergarten, which is completely clueless.

The phrase "I'm too hard" is the most appropriate to describe the middle-aged people who trade stocks.The current midlife crisis has actually begun to spread.

However, under the crisis, middle-aged people who jump into the hell-level copy may not know what they are facing.

If you have accumulated ten or twenty years of experience in your daily work, then you are a veteran.

But switch to the stock market, and you are just an ordinary person without experience and accumulation.

Every transaction is like a newborn learning to walk, trying it over there.

What's more worrying is that no one is leading you, supporting you, or helping you move forward.

This is like the group of people who go out to make a living in their teens, and it is easy to take the wrong path or keep falling.

It doesn't matter if you fall while walking, just get up.

Falling in the stock market means that part of your principal is lost.

After falling a few times in a row, your capital is gone, and the opportunity to make money is gone.The rules of the capital game do not allow for repeated trials and errors, with everything resetting to zero.

Therefore, it is essential to think clearly before entering the stock market, whether you really want to go down this path.

If you enter the stock market with a try-it-out mentality, and after trying, making mistakes, and hitting the southern wall, you can choose to exit.

However, if you are very stubborn and insist on making a name for yourself on this path, then be well-prepared to face the challenges head-on.

Never hesitate, and do not set your expectations too high.

Investing in stocks is about getting started first; losing money is not terrible, the worst is to gain nothing at all.

Middle-aged people should be more mature, to distinguish which is more important between gains and losses, and experience and losses, in order to go further.

Comments