A friend told me today that at the end of last year, when he said he was going to buy the bottom of the A-shares, he invested 2 million yuan to buy at the bottom. After the New Year's Day, there was less than 1.5 million yuan left, and in just one month, he lost more than 500,000 yuan.

He still hasn't dared to tell his family about this, for fear of being scolded.

He asked me what to do, feeling that he was deceived, but he was unwilling to give the money to the market for nothing and was eager to make a comeback.

More importantly, he feels that now is closer to the bottom and is unwilling to stop the loss and leave the market, not admitting defeat.

At this time, he is very much like a person who has lost all his money in the casino and is still unwilling to leave the table.

In fact, I also had two times last year, with a drawdown of 500,000 yuan, one was from the end of June to the beginning of July, and the other was in the middle of December, both were heavy positions that stepped on some individual stocks.

To be precise, the position management was not in place, and it was not the fault of high-frequency trading.

In the final analysis, it was caused by a gambler's mentality, and each time it was a large drawdown after a large profit.

In the first half of the year, I made a lot of money in this round of AI, but stepped on a mine at the end of AI. In the second half of the year, I also made a lot of money in this round of Huawei, but stepped on a mine at the end of technology.

The principal loss of more than 10% is actually very serious, let alone a loss of more than 25%, which can make people unable to breathe.Many people will ask what the feeling is.

If this is the first time such a large loss has occurred, it is estimated that the inner defense line is prone to collapse.

But if it has happened many times, it is no longer surprising, after all, the A-share market is full of situations where losses exceed 20%.

What is truly despairing is not how much money is lost, but the prospect of getting back to even seems increasingly distant, and gradually fading away.

Losing money is not terrible, what is terrifying is that the losses continue to increase without any signs of improvement.

The reason for this is the intense desire to break even.

When you lose 20%, you must be thinking about how to quickly earn back 25% to break even.

In fact, you should forget about breaking even because it is too "out of reach."

If everyone thinks about breaking even after losing money, then it will never be possible to break even, because no one will do charity to give you money to break even.

If the essence of loss is decision-making errors, then the essence of making money is making the right decisions.What you need to do is not to focus solely on how to get your money back, but to find the right way to make money, and ultimately achieve profitability.

I have personally experienced three cycles of bull and bear markets, with great ups and downs, and the largest account had a paper loss close to a million.

Let's talk about what I was doing in the predicament, and how to "turn sorrow into strength."

Firstly, forget about getting your money back and start with the end in mind.

The reason for saying to forget about getting your money back is to avoid psychological anchoring and not to have any obsessions.

Many investors have obsessions, always staring at the numbers in their accounts while trading stocks.

Our goal in trading stocks is to make money, not to get our money back. When your goal is wrong, your trading actions will be distorted.

The current market value of the account is the money you have, and if you lose it, you lose it.

What rises back tomorrow is actually the profit from this starting point today.The so-called "beginning with the end in mind" is to accept one's profits and losses, and not to use gains and losses as the basis for judging future market conditions.

Secondly, calm the mind and find the problem.

Mental adjustment is a must for starting over.

Moreover, only after the mind is adjusted can the real problem be found.

The onlookers are confused, many mistakes made by investors, when they calm down and look, will find them funny.

For example, buying stocks based on rumors, or buying stocks casually, there will be.

There are also some people who are already with a gambling mentality, and they are wrong from the beginning.

Only by calming the mind and being objective and fair, can we find the problem, correct the problem, move forward, and get closer and closer to making money.

Third, adjust the strategy and move the position.

Since a mistake has been made, it means that the strategy is wrong, and adjustment is the only way out.Of course, if you firmly believe that your strategy is correct, you can also hold on stubbornly, but the probability of making money by holding on stubbornly is actually quite small.

If the market were as simple as just holding on stubbornly, then everyone could make money by holding on stubbornly.

In my view, moving 50% of the position is more reliable, because only this position can have a better adjustment space.

There is another key point.

Each round of capital speculation will avoid the area that was trapped in the last round, because the selling pressure is really too great.

Moving the position is to avoid heavy pressure and find new, better directions.

Fourth, wait for the market, look for direction.

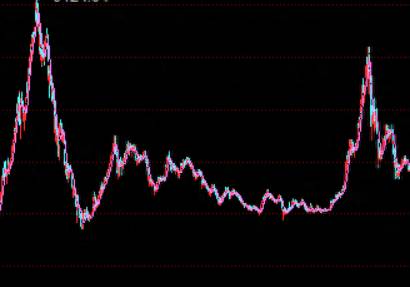

When the market falls too much, there will definitely be a market, which is a natural law.

However, when the market will come, how much it can rise, what is the main line, it is not known at the moment.

So, at this time, don't rush to buy this and that, it is easy to make a judgment error.At this point in time, the first thing to do is to be patient and regain control of the buying point.

Secondly, since there will be a market trend in the future, what is the main line of the market and where is the direction? This is very important.

To grasp the main line, you must be able to patiently pay attention to the market and find the direction of the funds.

The direction of the market is actually written on the plate, so those who have given up observing the plate will definitely miss the main line, at least a clear bottom.

Control your hands and wait patiently, which is the most important thing to do during this period.

Fifth, accumulate little by little to achieve profits.

Profits are not achieved overnight, but are slowly accumulated.

When you lose 20%, you need to rise by 25% to get back to the original, what you need to consider is not how to find a stock that rises by 25%, but how to achieve the accumulation of earning 25%.

What methods can be used to achieve profits, and how much risk is there.

If each wave earns 10%, then 3 waves can make money, so how should the wave be grasped?Do not always hope to buy a stock at full capacity and see it hit three consecutive daily limit-ups; the probability of this happening is extremely low.

When you get involved in a game with low probability, you are essentially doomed.

The way to make money in stock trading is definitely not through low-probability gambling, but through accumulating small profits. The essence of making money is the accumulation of profits.

Of course, if your trading strategy is very powerful and you find a bull stock to achieve a 25% profit, it is entirely possible.

It can only be said that in terms of strategy, you need to seek the possibility of making a lot of money, and in terms of mentality, you must be prepared to accumulate profits.

The sixth point, persist in reviewing and make it a habit.

The last point I have to mention is also the core of what I believe ordinary people can turn over in this market.

Many investors become very negative after losing money.

Plus, there are various opinions on the internet now, which will make people feel hopeless, and thus give up.

This giving up is not giving up on stock trading, but giving up on their rights, giving up on trading, and completely lying flat.And, one will no longer pay attention to the changes in the market, at most just check the changes in the account.

That is to say, in a bull market, you are busy with research every day, but in a bear market, you do nothing and ignore whatever happens in the market.

In fact, most of the time to accumulate experience is in the bear market, when you are losing money, and when the market is full of pitfalls.

Persisting in reviewing means knowing the changes in the market every day, verifying your own judgments, where you are right and where you are wrong.

You need to think every day, and you need to summarize even more, in order to keep up with the iteration of market cognition, and only then can you grasp the market trend.

Otherwise, when the market trend really comes, you are still waiting to break even with a blank look, and you can't find the direction to make money, and can only leave it to fate.

What have you learned from the lesson of losing 500,000 yuan, or the tuition you paid, is the key point.

Isn't the market trend just falling and then rising?

When you choose to respond passively, you have completely lost, because you have no way to compare with those professionals who are in the market every day.

They have lost money even in the bear market, so how can you go against the current?In this time when everyone's accounts are losing money, the one who is best prepared for the rise will be the ultimate victor.

Comments