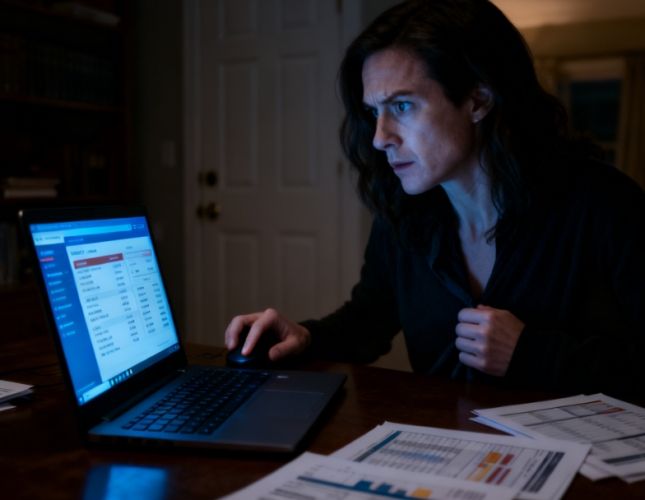

There is a belief that some investors are currently in a state of confusion and bewilderment. This is because their trading systems have been largely ineffective over the past six months to a year. In simpler terms, no matter how they adjust their strategies, they are still losing money. The majority of investors' trading systems do not include the option of being out of the market during a bear market, so it is normal to lose money in such conditions. Even super major players generally lose money in a bear market, which is nothing unusual.

However, if you notice that the frequency of losses has increased during a bear market, the ratio of gains to losses has become more skewed, and you are significantly underperforming the index, it indicates that your trading system needs to be adjusted. Losing money does not necessarily mean that there is a problem with the trading system. Every trading system will have times when it incurs losses. But if the losses exceed expectations, it suggests that there are significant flaws in the system's ability to avoid losses.

Many people tend to review and summarize their trading systems during a bull market.Because they made money in the bull market, they would think that their trading system is correct and extremely powerful.

Once in the bear market, they find that everything has changed, losing money while not being able to find the reason.

If they repeatedly increase the frequency of transactions using the trading system that made money at that time, the losses will increase more and more.

At this time, it is actually necessary to correct the loopholes in the trading system and fix the key issues.

Let's think about a few questions.

What are the reasons for the trading system causing losses, and where exactly is the problem?

First, is there a problem with the stock selection strategy?

Different trading systems will definitely have different stock selection strategies.

The applicability to bull and bear markets is also different.Most trading systems are based on technology as the foundation.

That is, they select stocks through technical patterns and volume conditions.

However, the underlying major investment targets are often screened manually.

In other words, investors determine the direction by choosing their own stocks, and then use the trading system to indicate whether to trade.

Generally speaking, the stock selection strategy will not ultimately be reflected in the trading system, and the stock selection and direction are still a personal grasp of the market.

For example, sector hotspots, industry trends, the development direction and performance expectations of listed companies, etc.

The stock selection strategy that the system can provide is mainly focused on the overall trend of bull and bear markets and the probability of making money in trading.

Second, has the buy selection changed?

Regarding the buy point on the trading system, has it undergone significant changes due to changes in the market style?

Most of the buy points in trading systems are relatively fixed signals.For instance, under what circumstances of volume-price relationship does a buy signal emerge?

When there is ample capital, an increase in volume is a standard indication of significant capital intervention, which is a standard buying point.

However, in a market with a fixed amount of capital, an increase in volume may indicate a significant divergence of capital, with the main force fleeing in large numbers, which can easily become a standard selling point.

Therefore, in the choice of buying, whether to add dimensional indicators is crucial.

For example, if a buy signal appears at a low position, and another buy signal appears during the decline, it is possible to continue buying.

But when the stock price is in a fluctuation, and a signal of a breakthrough with an increase in volume appears, whether to cancel the high-chasing purchase.

The change in the choice of buying, or the change in the dimension, when to increase, when to reduce, this is the core of the trading system.

Of course, the simplest way is to judge the direction through the trend, and then confirm the effectiveness of the buying point according to the technical pattern.

Third, has the profit-taking point changed?

Many people's stocks are not that they have not risen, but they have fallen after rising a little.The situation of riding a roller coaster is very common in a bear market, but not so much in a bull market.

In other words, the profit-taking point has actually changed.

In the trading system, once the profit-taking point has changed, it is necessary to start making adjustments, because it is necessary to lock in profits.

Originally, you might have made a wave of 20%-30%, but now you might have to settle for 5%.

In this case, lowering the profit-taking point becomes very important, or profit-taking in batches becomes very important.

Think about one question, after the profit-taking point appears, it is not that you have earned less, but the flexibility of the funds is higher.

Taking a 5% profit is not necessarily earning 15% less, but the position sold at 5% can go to find the next 5%.

The method of profit-taking in batches seems to reduce the expected return, but in a complete trading system, there is no impact.

The level of profit from quantitative trading is not high, but the frequency is sufficient, which can effectively accumulate profits, and in the end, it has become a representative of low risk and stable returns.

Therefore, the matter of improving the profit-taking point becomes urgent after a loss occurs.To conduct a statistical analysis of the maximum profit after a buying point, one must identify the standard for potential gains in a strategy in order to better grasp the profit-taking point.

Fourthly, is there an issue with the stop-loss point?

The final issue is the stop-loss, which is also of utmost importance.

If you find yourself consistently losing money, then the stop-loss issue is definitely not handled well.

Any trading system must have a stop-loss mechanism.

Because without a stop-loss, the extent of the losses is immeasurable.

There are no shortage of individual stocks that have fallen by 80% or even 90%, and not having a stop-loss means that the trading system may collapse.

In a bear market, should the tolerance for stop-loss be higher or lower?

Actually, it should be lower, with the protection of the principal as the top priority.

Consider this question: if the bull market is more about washing the market, is the bear market less about washing and more about the start of a new round of declines?Most of the losses you incur are not due to a washout, but rather because the rebound has ended, and a new round of decline has begun.

In other words, you have missed the profit-taking point, and when you reach the stop-loss point, it is time to choose to exit.

Of course, if you find that you have to take a stop-loss position every time, you should reflect on whether there is a mistake in the buying point of your trading strategy.

The key to correcting a trading system is how to improve your winning rate and increase the chances of winning.

A core variable in the middle is actually the change in market style.

Changes in market style at different times can lead to the failure of trading strategies, which is the key to the key.

This also determines that all trading strategies cannot be effective for a long time, and adjustments will be made continuously.

The last key point is how to slow down the pace in terms of trading frequency and position management.

The vast majority of investors cannot create a trading system that can trade at high frequency and has a huge winning probability.Because the ability to screen and review stocks is relatively limited.

In the limited selection of stocks and trading opportunities, grasping better trading buy and sell points is the core of building your own trading system.

This is a process, which may go through a lot of pain, but it will also become a sharp weapon for you on the investment road in the future.

Don't indulge in emotions every day, more often, be a researcher of investment, or even a bystander.

Comments