The A-share companies with a market value of over a trillion yuan are now down to seven.

Apart from the four major banks of ICBC, Agricultural Bank, China Construction Bank, and Bank of China, only Moutai, China Mobile, and PetroChina remain.

The era when white horses were prevalent and everyone was shouting the trillion-yuan slogan seems to have passed.

Insurance giants such as China Life and Ping An, new banking nobility like China Merchants Bank, representatives of new energy like CATL and BYD, and the second-largest liquor company, Wuliangye, have seen their market value shrink by more than half, with some only having five or six hundred billion yuan.

The second-tier white horses, including Midea, Gree, Hikvision, Mindray, Hengrui, and Great Wall, are all on the path to being halved in value.

There are now only over 40 white horses with a market value exceeding 200 billion yuan.

Haitian, which was aiming for a trillion-yuan market value back in the day, is now struggling at the 200 billion white horse line, no longer shining as it once did, with the scene of the setting sun in the west, trapping a large amount of capital at the high peak.

Some people say that it is the capital that has abandoned the big white horses, some say that the era has forgotten the big white horses, and some say that there will be no new market without the death of the white horses.

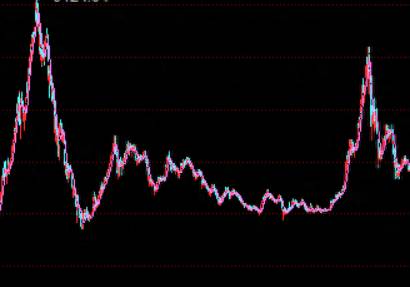

Since February 18, 2021, when the white horse sector reached its peak, it may have been destined that the era and title of the white horses will be abandoned by the A-shares.

Some people say that it is the massive flight of foreign capital that has led to the collapse of the white horses.Some argue that it is the domestic capital that has been selling off, leading to the continuous decline of blue-chip stocks.

Others say it is due to retail investors redeeming funds, which has caused the blue-chip stocks to fall without a bottom line.

All these theories are actually correct, because blue-chip stocks themselves have been abandoned by capital.

The endless trapped positions have completely locked the space for rising.

The reason why big blue-chip stocks are not willing to be speculated by capital is because there is no space.

Especially those that have not fallen much and are hovering around the price of being halved.

Talking about performance, the performance is indeed good, but there is no expectation beyond that, which is an open card.

Talking about growth, there is no growth to speak of, those with better performance can still have double-digit growth, and those with poor performance have already seen negative growth.

Non-high prosperity industries, enterprises that cannot double in the next three to five years, in the current market that is short of money, there is no capital that will touch it.

To put it bluntly, there is no space for rising, no imagination, and trapped positions are waiting to run away.No one dares to take on the role of the People's Liberation Army to rescue those on the mountaintop, let alone if they are not comrades in arms.

The performance expectations that cascade a thousand miles are always on the path of valuation reconstruction.

Not all big white horses can maintain their performance, and some have experienced a performance reversal.

Take the former Golden Dragon Fish and Haotian, for example, they are not talking about a significant decline, but they have all shown negative growth.

It should be known that the performance of negative growth cannot support any stock price, let alone a high valuation.

Bank stocks like China Merchants Bank can also be halved, because the valuation needs to be reconstructed.

The story of the white horse at that time was about the stable growth of core assets, but now even stability is no longer there.

Apart from Moutai, which can ensure its net profit by raising prices, how many companies can ensure the stability of their profits?

The already somewhat inflated white horse valuation, coupled with the expectation of valuation reconstruction, naturally becomes the ghost under the knife.

There is also a key point here, that is, those white horses that have already started to decline, whether there is still a way to climb the mountain in the future.This point, in the current economic climate, is something that needs to be questioned for a long time.

The lack of incremental growth that is as poor as being washed clean, is difficult to revive the once glorious dynasty.

The revival of a dynasty actually requires the promotion of funds, which is the essence.

Why is it that those dynasties, when they finally fled, would carry a large amount of gold, silver, and jewels, instead of an army for battle?

Because as long as there is money, it is relatively easy to organize an armed force.

As long as the green mountains are there, there is no need to worry about the lack of firewood; this green mountain is not the stock price, not the chips, but the cash flow.

Why is it difficult for blue-chip stocks to have a big market now, because the incremental funds are missing.

The public funds that are trapped at the top, don't they want to replenish their positions?

But who is willing to subscribe to funds in large amounts at this point in time? This is obviously a situation of having a gun but no bullets, which is futile.

The underlying logic of reviving the dynasty is gone, and the revival of the dynasty is far from being realized.To expect the big white horse (a metaphor for a once high-performing stock or company) to make a comeback, one would have to wait for a super cycle to smooth out the pain inflicted by the market.

Such a cycle could be as short as three to five years or as long as eight to ten years. Until the cycle is complete, the market cannot naturally heal.

Behind the chaotic speculation, lies the end of a story and a fate of disaster.

Retail investors might have truly regarded the white horse stocks as core assets, because this story has been repeatedly told.

But looking back now, one should understand that the concept of white horse is actually just a story told during the capital speculation.

When the story has become a story of the past, then the end has turned into a fate of disaster.

In simple terms, how to escape from the peak has become a question everyone needs to consider.

The former Hudong Heavy Machinery, later known as China Shipbuilding, also once told a story. This story was told at the peak of 300 yuan, and now the stock price is only 20% of that time.

High growth is a gift of the era, and this era will eventually pass.

That is to say, for many companies, the peak of the past is destined to be an insurmountable peak.Perhaps companies like Moutai, which can still grow steadily, will once again achieve the stock price glory of the past, or even set a new high.

However, among these large-cap stocks, at least more than half of the companies will no longer have the path to their peak.

For investors, the foundation of investment and trading strategies must change. It is no longer possible to forget about the account, hold it for several years, and make a huge profit.

More often, it is necessary to find opportunities to make money in the market fluctuations, corporate expectations, and stock price corrections.

White horses are not extinct, but they are aging.

Just like the elderly, they are easily forgotten by young people, and the same is true for blue-chip stocks.

There are some that can burst out with vitality and start a second spring, but they are a minority.

In the era of increasingly severe environment and the exhaustion of the demographic dividend, how many companies can find a second growth curve?

There will definitely be great companies, but they are ultimately a minority, and most will eventually fall into mediocrity.Compared to the hundreds of IPOs that take place each year, perhaps those young horses that are eager for sustenance are the future big white horses.

Investment itself, the first task is to look at the growth potential, followed by the stability of profitability. In an environment where capital is becoming scarce, storytelling and imagination have once again become mainstream.

In fact, performance growth is also a very pleasant story, but it needs to be verified every quarter.

When there is a deviation between this story and reality, the market will automatically make corrections, that's all.

Many white horses have now returned to the low valuation range, which is worth investing in.

However, expectations cannot be too high, and the opportunity to break out of a trend is very small, it is just a correction within the value space.

Investment, nothing more than valuation, price, growth potential, expectations, and capital, there is nothing new under the sun.

The rise and fall of stocks is nothing more than a cycle after another, and a reflection of the rise and fall of a listed company.

Comments