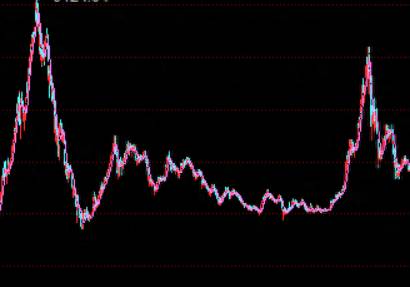

Have you noticed a phenomenon where the market can fleece retail investors amidst fluctuations?

In April 2022, the low point of the Shanghai Composite Index was 2863, which has not been broken to this day, but the account value of how many investors is already much worse than at that time.

Not only the market value of retail investors' stocks, but also the funds with more retail holdings have long since fallen below the net value of 2863, which is unbearable to watch.

In simple terms, the return rate of most retail investors is always a bit worse than the index.

This not only conforms to the result of retail investors losing more and winning less, but also reflects many problems.

One of them is that retail investors themselves are already at a disadvantage at the starting line of A-shares.

Perhaps many people will ask, what is the starting line of A-shares?

The starting line of A-shares is actually the Shanghai Composite Index, this huge weathervane.

Many retail investors may not have noticed that there is something called the All-A Index, which is the weighted index of the entire A-shares.

East Money has released the All-A Index and traced back to the history of 2001.The All-A Index truly reflects the ups and downs of all A-share stocks, making it a relatively reasonable index.

This index is actually the one that retail investors should truly refer to and must outperform; it is the real weathervane.

The reason why retail investors cannot outperform the index can be summed up in one sentence, involving two aspects.

Premature forecasting and delayed action.

What is meant by premature forecasting is that some retail investors like to make long-term forecasts in advance.

For example, such and such a stock will triple, quintuple, or even decuple in the future; such and such a stock is about to hit bottom now; buying such and such a stock now is the starting point of the rise, and so on.

Retail investors are inherently at the bottom of the information chain, yet they are expected to make investment forecasts ahead of large capital.

It is obviously unlikely to take the lead before the market sends a clear signal.

It is not that forecasting in advance is not allowed, because it is difficult to do well in stocks without judgment of the market.

But behind bold assumptions, shouldn't we be careful to verify?What is meant by "acting too late" refers to the tendency of some retail investors to engage in transactions with a sense of luck.

When a stock has already started to rise with increased trading volume, they remain indifferent and just watch quietly, as if they believe there will still be a lower point for them to enter the market.

When some stocks have already sent out signals of reaching a high position, they still hold on to a sense of luck, thinking that they will wait a few more days to see if there is a turning point.

They are half a beat slow in chasing the rise and half a beat slow in cutting losses, and this half beat has become a natural divide.

It is said that those who are aware first get the meat, and those who are aware later take over the plate, and this is the principle of the stock market.

The market always starts in hesitation and ends in blind following.

Of course, compared with the main force, retail investors also have two very big shortcomings.

The first is the direction of control.

In simple terms, the main force can determine the rise and fall of stock prices in most cases.

And retail investors are just ordinary participants, and they actually have no decisive direction for the rise and fall of stocks.Retail investors can only follow the steps of the main force to have a chance to make money.

Of course, the main force of a single stock often also conforms to the market trend and does not act independently.

When encountering a major bear market, the main force itself is also losing money, and there are very few who go against the current, not to mention that the main force is always profitable and not at risk.

However, compared with retail investors, the main force has a much higher chance of winning, and they can even be said to control the emotions of retail investors, harvesting the "leeks" back and forth.

This issue is difficult to solve, otherwise, the main force would not be called the main force, and retail investors would not be called retail investors.

The second issue is the information chain.

The information that retail investors get is almost all publicly available market information.

Those seemingly reasonable rumors are actually small essays written by various "water armies."

The most critical issue is actually some data and industry trends, which retail investors only know half a beat later.

The closest thing to information for retail investors is actually through the reaction of the market, not any public information.Nowadays, any information that retail investors can grasp is outdated. It's not just a half-beat slow, but rather directly taking over the baton.

On this starting line, retail investors are also definitely lagging behind, and it's a big gap, with no way to catch up.

There is no such thing as fairness in the capital market, and the starting line of retail investors is definitely left behind by capital.

So, do retail investors have no ability to outperform capital?

Retail investors definitely do, which is why some people have made a fortune through stock trading.

Those we call "stock gods" have made profits in the capital market that far exceed those of large capital.

Because the profit-making goal of large capital is to be stable first, and then to maximize benefits.

Retail investors themselves have many advantages, which determine that if the method is appropriate, they can overtake on the bend.

First, the advantage of flexibility.Main force capital buying stocks requires corresponding chips, and selling stocks also requires corresponding buyers.

However, retail investors have a very small capital size, and they can buy and sell whenever they want.

When the main force finds that the trend has changed and wants to escape, it is actually very difficult and needs to operate repeatedly.

But retail investors can complete trading transactions with a single click and can correct their views at any time.

Flexibility is the biggest advantage of retail investors and the key to beating the main force capital.

Main force capital is relatively large, once it hits a mine or the overall situation is not good, it is actually very difficult to stop losses quickly.

But retail investors can empty their positions in an instant, minimize losses, and the key is how to judge the direction of the market.

The advantage of flexibility makes it easy for retail investors to make changes in trading and adapt to various market conditions.

The key issue is whether flexible retail investors can effectively leverage their flexibility advantage instead of blindly engaging in high-frequency trading, which is completely different.

Second, the advantage of risk preference.What is the advantage of risk preference? In essence, it means that retail investors can afford to lose.

Major players cannot afford to lose, as they will be forced to liquidate if they lose 20%, so they are very cautious in their transactions.

Retail investors can always start over after losing everything, as long as they do not use a large amount of leverage, they can still afford to lose.

This leads to retail investors having a very high risk preference, while the risk preference of major players is relatively lower.

Don't look at some of the stocks that are hyped by funds, or stocks that have increased tenfold, and don't think they can earn a lot.

If you really understand the actual situation, if their returns can reach half of the actual increase, it is already very good.

Among the retail investor group, the proportion of people who make money is definitely a minority, and those who make a lot of money are extremely few, but a very few people have earned the money that most people have lost.

It's not about seeking returns in risk, but the advantage of risk preference can be effectively utilized in strategy.

Third, the advantage of capital efficiency.

The so-called advantage of capital efficiency refers to the high utilization efficiency of retail investors' funds.Compared to the main force that requires strategic deployment, the cycle for accumulating chips is quite long. Retail investors have no need for this, and it can be said that they can buy in a second.

When it comes to selling, they also have the same advantage.

Moreover, retail investors can sell a stock and quickly deploy the next one, but this is something the main force cannot do at all.

Therefore, in a big bull market, there will be retail investors who can increase their holdings by tens or even hundreds of times in a year.

However, for the main force capital, a return of three to five times is already the ceiling, and it is already at the top of the industry.

This also leads to the theoretical existence of the dream of wealth creation for retail investors. A bull market can indeed breed a lot of outstanding retail investors.

Those who say that retail investors are not as good as big capital and main forces actually do not understand the real logic of stock trading.

For some stock experts, the biggest challenge is not the return rate, but when their capital volume becomes larger, the strategy is easy to fail, and it is easy to be targeted by other capital.

Some strategies may be applicable to tens of millions or hundreds of millions of funds, but once they reach tens of millions, they are no longer applicable.

It should be noted that ordinary small speculators, with a capital volume of only two or three tens of millions, can get on the Dragon and Tiger list.There are many strategies that become less effective once the scale of capital increases.

Retail investors are inevitably at a disadvantage at the starting line, but there are plenty of opportunities to overtake on the bends, the key is whether the technical ability is in place.

Comments