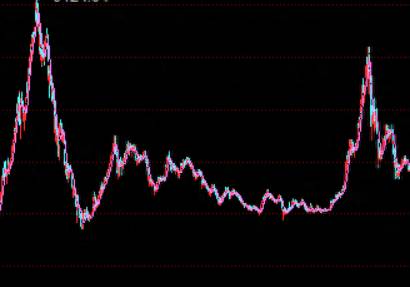

Looking back at the long history of A-shares, in fact, there are countless cycles of bull and bear markets of all sizes.

Each time before, it could be resolved smoothly.

Or it could be said that the causes sown in the bear market have borne fruit in the bull market.

Behind this, in fact, is a batch of stock investors after another, bringing a golden age of capital to the market.

Starting from the first generation of old stock investors in Shanghai and Shenzhen in the 1990s, fresh blood has been continuously injected into the market.

Setting aside the group who bought subscription certificates, the first generation of stock investors really concentrated on the market in 1996.

And from 1996 to 2001, it was also the prototype of the first round of bull market. The index soared from more than 500 points to 2245, nearly quadrupling.

After the seemingly joyful bull market, there was a crisis of trust.

Starting in the second half of 2001, the index plummeted and fell to a point that everyone remembers, 998.

The whole cycle just went through four years.This bear market cycle ended with a large number of retail investors losing their shirts, some incurring debts, and a very few jumping off buildings in despair.

The first bear market in four years severely damaged the mentality of retail investors, with a significant number stating that they would no longer play the stock market and lost faith in it.

Ultimately, the proportion of these investors is still quite small.

In that era, the internet already existed, but there were very few netizens, and smartphones were just starting out, all of which were black and white.

Trading was mainly done through telephone orders, not like now where you can buy and sell with a few taps of your fingers.

Only those big players, sitting in the big player rooms, could type on the keyboard to buy and sell.

But this part of the retail investors, after all, accounted for a very small proportion, and the region was mainly concentrated in first-tier cities.

In 2006, the second round of the bull market started, with the index soaring by 6 times, reaching 6124 points.

This bull market added a lot of fresh blood, whether it was listed companies, retail investors entering the market, or public funds, which also ushered in the first round of fundraising peak.

The arrival of this peak was mainly due to the development of the securities industry, the promotion of sales channels such as banks, attracting a lot of incremental funds to enter the market.The spring breeze of stock reform blew fiercely. About a year later, the retail investors who had already forgotten their pain, with their families and friends, rushed in together.

Financial television media had already been very developed at that time, with online and offline synchronization, attracting a lot of new capital to enter the market.

There must always be someone to pay for the bull market, and those who pay must be the funds that follow the trend.

The financial crisis of 2008, coupled with the plummeting index, was like a mudslide, showing no intention of stopping at all.

From 2245 to 998, it was just a little more than a halving, but from 6124 to 1664, it was almost 3/4 of the cut.

Wailing, wailing, wailing, this time the blow was no longer aimed at individuals, but at the families who took over at high positions. At that time, there was no such thing as turning off the lights to eat noodles, only uninstalling the account and lying flat completely.

It was really desperate at that time, but it seemed to be a little better than now, because it was already numb.

Although the internet had already existed at that time, there was no circle of friends, and there was no communication between people who did not meet each other.

In addition to the originally crowded corner of the park, the stock exchange, it has become desolate, and it seems that this matter is not mentioned by everyone, and it has been forgotten.

The pain of 2008 was somewhat soothed in 2009, but from 2010 to 2014, it was also a four-year bear market, and the lethality was not much worse than that of 2008.Do you still remember the end of 2012, when the index once again broke below 2000 points? At that time, there was still the Mayan prophecy, saying that the Earth was going to be destroyed, and the market's pessimism for several years all burst out at once.

What's more cruel is that after a small rebound, the index fell below 2000 points again in mid-2013, falling to 1849.

At that time, no one believed that A-shares would be good again, with various fraud scandals, various insider information of the market manipulators, and retail investors thought it was completely hopeless.

Let alone confidence, even the courage to eat noodles was gone.

To be honest, the situation was even worse than it is now, but the impact area and range were not as large as they are now.

At that time, there was no TikTok, no headlines, although there were social circles, but not so many people were watching.

People didn't like to curse A-shares at every turn, and most people were silent.

Waiting may have results, and most people also saw the bull market from 2014 to 2015.

That was another "fraud" market of the big A, because the money for the market hype was borrowed.

The end of the leveraged bull market is that funds need to withdraw from the market, causing a sharp drop.This is the fourth bear market onslaught, in addition to the plunge in 2015, it also superimposed the circuit breakers at the beginning of 2016.

Moreover, this round of onslaught lasted for three minor rounds, the first round from 5178 to 3373, approximately one month, the second round from 4814 to 2850, lasted for a month, and the third round was from 3684 to 2638, also lasting for a month.

In other words, within just half a year, three rounds of crashes of about 30% each, directly knocked the market down.

Fortunately, this round was a short-term sharp decline, and the market saw a slow bull market in the two years of 2016-2017, gradually regaining confidence. Except for some investors who were forced to liquidate, the pain of the vast majority of investors was soothed.

The injured liquidated and left the market, and the rest were soothed by time. Even if 2018 was another bear year, it did not affect the trust in the entire A-share market.

On the contrary, the bull market from 2019 to 2021, public funds, completely led a group of fund investors into the pit, becoming the last straw to break the market's back.

At the end of 2018, the number of registered users in the stock market was about 148 million, and the actual active accounts were less than 50 million.

However, the data for 2022 shows that the number of registered users in the stock market is less than 200 million, but the total number of fund investors has surged to 600 million.

That is, the total number of stock investors + fund investors, or the number of active accounts, can be about 400-500 million.

That is, the actual number of people participating in this market has increased by nearly ten times, even if some only bought a few hundred yuan worth of funds.Since 2021, the collapse of funds has been far more devastating than the decline of stocks. The mentality of fund investors is more explosive compared to that of stock investors.

The so-called trust crisis is the feeling of every participant in the market, not just one or two individuals.

Although we don't hear many stories about people jumping off buildings due to sharp declines, the emotional venting that comes with it spreads wildly on the internet every day.

All problems have erupted in a concentrated manner, but there are no solutions.

Although the internet has memory, its memory is actually very poor, which gives the market a reason to make a fuss.

The emotions of retail investors are low today, high tomorrow, and low again a few days later, and so on.

Plus, various public statements have ultimately led to a continuous decline, which has once again plunged the market into a trust crisis.

No one believes that there will be funds to rescue the market, only by continuously filling in the pit to buy, the deeper and deeper.

The pain of this time is more severe than the pain of the past.

It's not because of a greater decline, but because the impact area is larger, and the market sentiment is worse.Sometimes, I really admire those self-media outlets that grab attention for traffic; they are another accomplice in the endless decline of this market. The more unstable the emotions of retail investors, the greater the space for "harvesting the leeks" (a metaphor for taking advantage of inexperienced investors).

This round of adjustment is destined to shear the market bare, to the point where trust in the market collapses. Of course, the trust in this market is essentially based on the effect of making money. When there is money to be made, everyone is happy; when there is no money to be made, people vent their emotions on each other, which is human nature.

Finally, let me say something that perhaps should not be said. Looking at history, many problems are not really solved, but are covered up by the prosperity of the times. Similarly, the rise in the stock market will cover up many underlying issues. If these issues are not resolved, the market will eventually go through cycle after cycle.As for whether these issues can be resolved, it depends on whether the root causes of the problems are addressed and whose interests are affected.

I believe in the systems and institutions of the big A, which can become better and better through the cycles of time, giving retail investors more confidence in their investments.

Comments