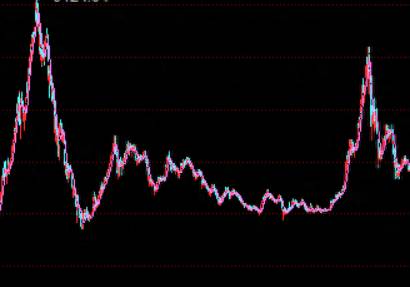

Just after the New Year's Day, the stock market has once again faced four consecutive days of decline, it could be said that it has wiped out the last penny of the retail investors.

The flame ignited by a matchstick was extinguished by a sudden downpour, drenching it from head to toe.

Exit! Exit! Exit!

Apart from the loudest call to exit, the rest is the sound of deception.

But it is clear that the market ignores the cries of all retail investors, and even more willing to hear the cries of retail investors.

Those who hold a large amount of cash in their hands are watching the market joke with relish, waiting for cheap chips to fall into their pockets.

Those who are still shouting must not be desperate, because those who are truly desperate have already left the market.

The vast majority of retail investors are waiting for someone to clean up the mess, waiting for someone to take responsibility for the stock market.

After all, the market will not continue to fall, and there will always be someone to pay for this wailing.

Indeed, after each major decline, there will be a certain rebound.The only thing that varies is the length of the downtrend, when the rebound will come, and how strong the rebound will be, each time it's different.

Some people, the price they bought in at, has already reached a level where they won't break even in a whole market cycle.

For example, those who were stationed at 6124, 5178, or like China Petroleum, those who bought high-priced blue-chip stocks at high positions, are already beyond the reach of any market trend to untie the knot.

In the capital market, you are only responsible for yourself, no one will be responsible for you, because being responsible requires investing real money.

In the world of capital, who would give money to others, everyone is just holding their own pockets tight.

Even the rise of stocks is not to give you money, but to attract more capital into the market, to let them take over the plate.

The ultimate investors who take over the plate are the big suckers, the ultimate responsible person for the whole market.

The reason why retail investors have a biased understanding of the market is that the vast majority do not have operational awareness, no chip awareness.

In the eyes of retail investors, the purchase and sale of stocks are just in an instant, and there are very few situations where chips cannot be bought or sold.However, from a global perspective, it is the game and operation of capital.

Let me give you a few examples.

For such large-cap blue-chip stocks with such a large market value, is there really capital willing to take over and continue to push up the stock price?

There are so many trapped chips above 3400, who is willing to be the liberating army to untrap the chips above?

If the market wants to make a move, is it better to challenge the high position or to fall first and pull out the rebound space?

Without the following plate, the stock price is pulled very high, and finally, who is the goods delivered to?

Many questions, if you think from the perspective of capital, it will be clear.

Think about another question, if the retail investors all make money, who is the philanthropist, and who loses money?

Some people will say that there is incremental capital in the market, and those who come in later fill the pit for those who come in earlier.

It is indeed true that in a bull market, there is a large amount of incremental capital acting as philanthropists.In a bear market, there is no incremental capital, and there are absolutely no philanthropists; only capitalists come to harvest.

The end of the game of existing capital is that the big fish eat the small fish.

Why do I feel particularly miserable recently? It is because quantitative funds have accelerated the process of this existing capital game, quickly sweeping through the entire market.

Originally, the market would give you a piece of candy, and then give you two slaps.

Nowadays, it's just about slapping, and there's no such thing as giving you candy at all.

Many people have been waiting for the market to be rescued. I said before that the so-called market rescue is actually to copy the bottom of retail investors.

From the perspective of chips, the market rescue is a large amount of capital, copying the chips at the bottom, and then starting to lift.

If everyone holds back and does not sell stocks, there will be no chips coming out, and there will be no bottom fishing, and there will be no market rescue.

Therefore, all the bottoms and tops seem to be a game of chips, but in reality, it is a game of human nature.

Collective trading behavior brings about phased tops and bottoms, which are unrelated to valuation, unrelated to policy, and related to emotions.History does not sympathize with the weak, but respects the strong; the capital market has never been about protecting the weak.

This is a point that I believe all investors still in the A-share market must deeply realize.

Because this is the foundation for retail investors to continue moving forward. If they fail to recognize this, it is basically impossible to make money in the market.

It's like you've entered a vast desert. You can turn back or rely on your abilities to walk out of the desert.

But expecting someone to prepare a place for you to rest in the desert, to serve you tea and meals, is impossible.

In fact, there are only two paths in front of you.

The first is to retreat as soon as possible, regardless of profit or loss.

No one will be responsible for retail investors, but retail investors must be responsible for their own wallets. The loss is their own money.

Knowing when to retreat is not a bad thing.The focus is not actually on profit and loss, but on whether there has been any growth at all.

There are some investors who do not grow, but instead bear a particularly heavy psychological burden.

The daily fluctuations in profit and loss can bring a huge psychological burden, especially in a long-term bear market, which can suffocate them.

For these investors, only by letting go of their stock accounts can they achieve results.

They often invest more than they can bear, which makes the loss particularly painful for them.

If you reduce the funds to 1/10, you will find that the situation will change a lot.

You are not indifferent to profit and loss, but can bear the impact of these losses on you, and can better observe the market.

First, reduce the scale of funds to a range that will not affect the investment mentality, and then reconsider the problem.

If even investing tens of thousands of yuan will still affect your trading mentality, then hurry up and escape, don't touch stocks anymore.

The second point is to adjust your mentality, withstand the pressure, but to find a way out.The reason why it's hard to make money in the stock market is due to both mindset and method, which you must possess.

Among these, mindset accounts for more than 80%, while the method accounts for about 20%.

The vast majority of investors, especially men, find it difficult to pass the mindset barrier.

Female investors, on the other hand, tend to have a smaller proportion of losses, precisely because their ability to adjust their mindset and withstand pressure is relatively stronger.

When trading, once you fall into the emotional trap, it is essentially a foregone conclusion of loss.

The reason why chasing rises and selling falls is prone to mistakes is that it is a manifestation of human nature.

Adjusting your mindset, understanding what stock trading is about, and what kind of risks you are facing, is the top priority.

Secondly, stock trading itself still requires learning, needs to go through tempering, and finding the right method.

It is said that it is easy to make money in the stock market, but most people do not, such as finding a stock to buy high and sell low, which is easy to say but difficult to do.

Because the market will have temptations, most people find it hard to execute their trading plan, that's just the way it is.Execution power is on the same level as the method of stock trading. The unity of knowledge and action is actually not as difficult as imagined to explore a profitable method in the stock market.

If you cannot find your way out of these two paths and continue to be lost in the desert, what awaits you, even if it is not a dead end, will be a severe setback.

Making your own choice as soon as possible is the most correct thing to do.

Comments