Written at the tail end of 2023, for all the retail investors currently anxious in the market.

Someone asked me if I am anxious, of course I am.

But the cause of my anxiety may not be the same as everyone else's.

What I am anxious about is not how much money I have lost, but the astonishingly long downtrend of the A-share market.

Take the most heart-wrenching photovoltaic sector as an example, which has been declining for six consecutive quarters.

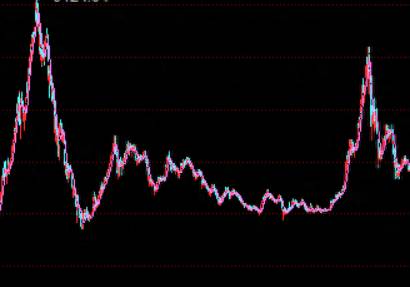

The blue-chip stock hub, the CSI 300, has been falling for three years.

The ballast stone of the market, the SSE 50, has also been declining for three years.

The same situation has also occurred with the STAR 50, with three years of negative lines, and the monthly line has even been nine consecutive negative lines.

The decline of the A-share market may not be particularly deep, but the length of the downtrend has reached the point of being heart-wrenching.

Many of the declines have never occurred in the history of the A-share market.In comparison to the steadily growing GDP each year, has the A-share market taken a laxative?

A nine-day consecutive decline like that of the Science and Technology Innovation Board can lead to misunderstandings, as if some major disaster has occurred in the fundamentals.

However, the reality is that there is no serious problem in the fundamentals, and it can even be said that there is no problem at all.

The essence of the problem does not lie entirely in the fundamentals.

The essence of the problem lies in the reluctance of capital to enter the market, and instead, it is continuously withdrawing from the market.

At the beginning, we blamed it on foreign capital.

Due to the interest rate hike cycle of the US dollar, there was a significant outflow of capital from the northbound channel, and a large amount of foreign capital withdrew from the Chinese stock market, wantonly selling stock chips.

But others say that they bought and bought in the A-share market, but they couldn't buy enough, and ultimately left at a loss, not making any profit.

In addition, the proportion of northbound and foreign capital is actually very low, and it is not enough to make the market take such a continuous decline.

To put it bluntly, even if the capital unilaterally sells off, regardless of the cost of clearing stocks, the time cycle will not be so long, and the decline will not be so large.The essence of the problem is certainly not here.

The essence of the problem lies in the fact that the capital of A-shares is still waiting and unwilling to enter the market.

Since the market reached its peak in 2021, incremental capital seems to have disappeared.

In the past two years, the market without incremental capital has been harvesting each other, and the existing stock has been exhausted.

The major mainstream capitals seem to have completely laid flat.

From the perspective of securities firms, the number of new accounts entering the market is getting less and less.

From the perspective of public funds, many funds are unable to be established, and there is no capital willing to invest.

From the perspective of quantitative funds, the market has been harvested repeatedly, and the existing stock has been exhausted.

From the perspective of main funds, the main line of the market is scarce, and it can only be done 1-2 rounds a year, and it can only make money by focusing on a few sectors.

From the perspective of speculative capital, the number of followers is getting less and less, and it is getting closer to the game between speculative capitals, and the difficulty has increased a lot.From the perspective of the social security fund, in 2022, due to excessive withdrawal of market liquidity, the social security funds have started to lose money.

Stock means consumption, the longer the time, the less the funds to do more, and the market needs to continue to move down to the platform.

Therefore, the problem returns to the essence, the market needs the intervention of funds to warm up.

Otherwise, this lukewarm trend may last for a long time, even if some stimulating policies are introduced, it is difficult to fundamentally change the market pattern.

Funds are waiting, but few people can say what the funds are waiting for.

What kind of situation will trigger the entry of funds to reverse the current situation of A-shares.

What is A-shares waiting for?

Next, I will elaborate on my own views from five aspects.

1, waiting for policy.It seems that policies have been frequently released in the past two years, but their impact is relatively limited.

To completely reverse the situation, a super policy stimulus is needed to change everyone's expectations.

It is unrealistic to rely solely on verbal statements, if verbal statements were effective, the market would be in chaos.

Because once there is a verbal statement, the market will soar, and once it plummets, the market will again make verbal statements, which is a vicious cycle.

The policy itself is not primarily focused on the stock market, but first and foremost, it is important to stabilize the entire economy.

2. Wait for capital.

The market needs capital to recover its vitality.

The current market is very short of capital, or rather, it lacks a leading force.

Large capital has become accustomed to waiting and watching, and not entering the market to take a long position, so it requires a larger and more powerful capital to enter.

A slight increase in the position by the central bank alone cannot solve the problem.Without an influx of funds at the trillion-level entering the market, it is difficult for liquidity to undergo a dramatic change; what is meant to happen will still happen.

Only with the forceful intervention of large capital can there be a possibility of turning the situation around.

3. Waiting for the cycle.

The so-called cycle is actually the foundation of speculation.

Speculative funds will definitely intervene at a certain node, starting to buy, and then driving the market trend.

These actions themselves require time.

Time is used to build positions, and also to erode the hope in the hearts of those who are trapped.

The matter of the cycle is inevitable, it will definitely happen, and it must be resolved over time.

Haste makes waste; after a major bull market, there seems to be a 3-4 year bear market cycle, which has become a convention in the A-share market.

4. Waiting for the opportunity.The opportunity is really important, because once the ball drops, it must rely on an external force to bounce back up again.

The market needs a catalyst to ferment as a whole and to change the dynamics of attack and defense.

This opportunity could be a policy, or it could simply be the trend of a single day, a tipping point.

When pessimistic investors can no longer bear it and sell off their stocks indiscriminately, the opportunity arrives.

When fund companies can't withstand redemptions and a situation of mutual killing occurs, the opportunity also comes.

The opportunity is very elusive, but it will definitely happen, at some time and moment, suddenly it will erupt.

5. Waiting for the price.

The market is waiting for a good price, a lower valuation, a price that cannot lose.

Every bottom is always a bit lower than imagined, because capital is waiting for a good price to buy in.

For large capital, they will be more concerned about 3%, 5%, and be very particular about every detail.For them, they will only take action when they dig into the basement; otherwise, it is far better to invest the money in some stable projects to pursue a decent fixed return than to tinker in the stock market.

As the saying goes, the right timing, the right place, and the right people are all indispensable.

The smartest capital will only take action to bottom-fish when the certainty is the strongest.

They pursue the ultimate risk-reward ratio, preferring to wait and miss opportunities rather than letting risks run rampant.

The current environment of the A-share market may be the worst in the past decade or so, just like the economic situation, the challenges encountered are the greatest, and the two are synchronized.

The cycle, this thing, policy can only assist in some stimulation, and essentially needs self-repair, which cannot be rushed, and can only wait.

The waiting of the A-share market may not have come to an end yet.

Ups and downs are just appearances made by capital to make money during the waiting period.

The real big opportunities may still be far away, and we have to continue waiting.

Comments