Does the main force come along with policies?

Does the main force come along with performance?

Does the main force come along with themes?

No, the main force only enters the market to make money.

In fact, all the above are just auxiliary information, not the main reason for the main force to enter the market to speculate on stocks.

The first goal of the main force entering the market is always to make money, and what serves the first goal of making money is called the money-making effect.

Sometimes you may not realize it.

If the market is waiting for the bottom, and no one is lifting the sedan chair, the market's end will only continue to fall.

That is to say, the funds will only personally enter the market after seeing other funds make money.

Therefore, some stocks with no themes, no performance, and no policy support, still soar into the sky.Because the capital is not coming for performance at all, but simply in search of a community with the same philosophy.

It doesn't matter if there is no theme; speculation itself is a simple theme.

If there is no concept, then just create one. It's possible to simply speculate on a name, or even on a code.

And when the capital chooses to lie flat, it is almost impossible for the market to recover quickly in the short term.

Everyone is bustling about, all for the sake of profit.

Considering the issue from the perspective of capital, this idea is actually completely unproblematic.

This market seems to have no vanguard, only capital that allies because of interests.

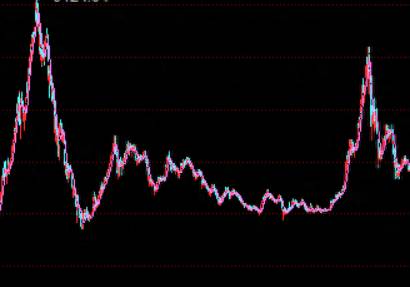

The whole market is waiting for the bottom to come, so why has it fallen for so long, and the fall is not small, but there is still no capital to bottom fish.

Especially for the already very cheap Shanghai Composite 50 and CSI 300, why are the main forces not interested?The main force will tell you one thing, that is, a low stock price does not necessarily mean that buying will make you money.

A low stock price only means that the cost of buying the stock at the moment is very low.

As for when to make money, it will happen when there are other funds willing to buy the stock at a high price.

There is a biggest problem between now and the future, which is the issue of the time cycle.

Just like we all know that the stock market will eventually rise to 3000 points.

This statement is correct, but no one knows when it will happen, only knowing that it will be in the future.

It is unclear whether it will take 1 month, 3 months, 1 year, or 2-3 years.

The longer the time cycle, the worse the profit effect, and the lower the actual return on capital.

In fact, large capital only does one thing, which is to make the corresponding investment at the right time node, rather than the wrong one.

The standard for measuring the right or wrong of this node is actually the profit effect.There is another very important point that is often overlooked by ordinary investors. It is not the cost of time, but the risk factor on the timeline. We have an old saying, "Delay breeds changes." That is, as the time cycle is extended, some unexpected things are likely to happen. Our current predictions are based on the current market environment for deduction. No one knows whether the market environment will change significantly in half a year or a year, whether the market environment will improve or continue to deteriorate. That is, the risk factor is actually dynamically changing, which will affect the decision-making and investment results in the middle. Large funds will calculate all the opportunity costs and risk factors clearly before making investment decisions. It is obvious that when the profit effect is insufficient, they are more willing to hold the currency and wait and watch, to avoid the occurrence of risks.In addition to the price being sufficiently low, what are the other reasons that can make the main force enter the market and take a long position?

From the perspective of capital making money, making money is the only purpose and goal of capital.

Looking at the motivation and process from the result, the issues that capital considers are these.

1. Whether there is a follow-up capital.

The first issue that capital considers is how to withdraw completely.

Even if it is not possible to ensure a 100% complete withdrawal, at least it is necessary to ensure a smooth exit.

Why the market with reduced volume will always fall in the dark, and the possibility of a stock falling with reduced volume is very large, in fact, the principle is the same.

The first point of capital's game in the market is not to consider how much to earn, but to consider whether there is capital to take over, whether it can allow oneself to exit.

Even if it is to exit at a loss, at least most of the principal can be recovered. If there is no one to take over, then the problem is big, because the main force wants to leave but can't.

The effect of making money is one aspect, and considering the way out is often the first priority.The agglomeration of capital is the foundation for highlighting the effect of making money, and it is also the core that capital is willing to layout and personally participate in.

2. How much is the market space in the end.

Main capital is very smart, they want to speculate in the market, the first thing they look at is the risk and return ratio of investment.

They will never take the risk of losing 30% to make 10% money.

In their eyes, they only do business that makes more losses and less profits, and the space for making money is very important.

This is also why we always feel that the valuation is about the same, and the capital should enter the market.

However, the capital often copies to the basement each time, because the capital needs space, part of the space, is the basement that appears under the floor.

You think the reasonable stock price is 10 yuan, the main force often has to bottom out at 8 yuan, because the 25% space from 8 to 10, the main force wants to take it in the bag.

Moreover, the risk of 8 yuan is far less than 10 yuan, and setting it as the starting point is also more advantageous for the main force.

Especially in the market that is short of money, the capital will choose to wait, patiently wait.3. How long is the market cycle approximately?

Funds have an advance prediction for the market cycle.

Especially the main force funds, they never fight unprepared battles.

Whether it is a small cycle rebound or the arrival of a big cycle bull market, funds will make a prediction in the first place.

Because the big cycle is definitely bottom-fishing blue chips, and the small cycle is grabbing short-term hot topics.

Of course, the market itself is a step-by-step process, and the cycle cannot be accurately judged, but it will first estimate the strength and sustainable time of the rebound based on the cycle of the decline.

Main force funds will definitely have many sets of plans, but each set of plans will have a budget for the time cycle, because this affects the actual annualized return rate.

4. Whether policy guidance is positive.

Whether the main force enters the market, it is also very concerned about policies.

This kind of policy attention is not the policy that ordinary retail investors see, but some underlying policy guidance and so on.The major policy direction and the interpretation of the main capital require much deeper understanding, as they need to judge the direction. Just like the phrase "vibrant market," retail investors may think it means a general rise, while the main capital believes it's time to speculate heavily on themes, which is a completely different interpretation.

Positive policy guidance is the foundation of investment. It is said that the market is a policy market, which is actually this principle.

It is necessary to be consistent with the capital direction guided by policy, to huddle together for warmth, and to create a profit effect.

5. What is the logic of speculation?

Capital speculation must have an underlying logic, as speculation requires a market.

Why does it rise? Why can it be speculated? Why can it make money?

Is it because the valuation needs to be repaired, or the economy has improved, or it has fallen too much and needs to rebound, or is the big bull market coming?

A complete set of underlying logic is a major factor supporting the market.

To put it bluntly, capital also needs to tell stories to others and find the so-called "bag holders" to take over.This logic, eventually, the retail investors will all come to know, because they are the ones who follow the logic to take over the market in the end.

The logic of blue-chip stocks is, the logic of new energy is, the logic of AI is, and the logic of Huawei is too; all these logics eventually weave into a story, which becomes the most potent poison.

Funds are more astute than retail investors imagine; they will only take risks to enter the market in the face of absolute benefits.

Currently, no one in the market is willing to bottom-fish, because the absolute benefits are not enough, and they believe that the risk factor is still relatively high.

Or perhaps, without the vanguard of peer funds, the main force remains on standby, waiting.

It is actually impossible to be smarter than this part of the funds, but to quickly follow this part of the funds and to listen to the stories with a skeptical attitude is actually something that retail investors can achieve.

Comments