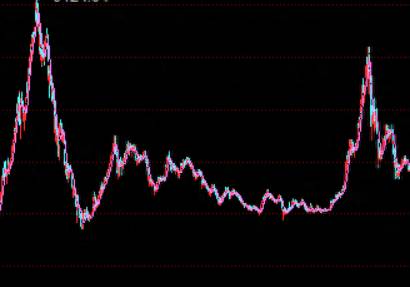

Since the index rose above 3000 points in 2020, there have been four instances in the last four years where it fell below 3000 points.

On April 25, 2022, the Shanghai Composite Index (SCI) broke through the 3000-point threshold, reaching a low of 2863 points. It regained the 3000-point mark on April 29, and completely bid farewell to the 3000-point level on May 10. During this period, there were a total of 8 trading days when the index was below 3000 points.

On October 10, 2022, the SCI fell below 3000 points again, reaching a low of 2885 points. It completely said goodbye to the 3000-point level on November 4. During this period, there were a total of 13 trading days when the index was below 3000 points.

On October 20, 2023, the SCI broke through the 3000-point mark, reaching a low of 2923 points. It completely bid farewell to the 3000-point level on October 27. During this period, there were a total of 6 trading days when the index was below 3000 points.

On December 5, 2023, the SCI fell below the 3000-point mark once again, and it has been 32 trading days so far. Compared to the previous three times when the index fell below 3000 points, the duration has been significantly extended.

Why has it lasted so long this time below 3000 points?

Looking at the previous instances when the index broke through 3000 points, capital quickly took advantage of the bottom chips and then started the market trend.

This indicates that capital regards the chips below 3000 points as a treasure, and it takes them all in panic.

However, this time, with more than 30 trading days below 3000 points and the cycle extended, there are only two possibilities.

The first one is that the willingness of capital to collect chips is not very strong.In the current market, there are signs of incremental capital entering, but the actual volume of funds is not very large.

Especially in the range of 2900-3000, it seems that the capital's willingness to hold positions is relatively weak.

That is, there has been no initiative by capital to actively accumulate shares.

After breaking through 3000 in the previous instances, medium-sized bearish and bullish candlesticks appeared alternately.

But this time after breaking through 3000, there are more small bearish and bullish candlesticks, indicating an increased willingness of capital to lie flat and a passive buying and selling mentality.

This suggests that capital at this position has many considerations and has not generated much synergy, but rather more waiting.

What is being waited for is the stance of other capital, to make some following actions.

Even when seeing some blue-chip stocks building a bottom in advance, they are mostly small bullish candlesticks at the bottom, unwilling to buy at high prices.

The second type is that the amount of positions that capital collects is relatively large.

The reason why the bottom cycle is long is also because capital needs to collect a large number of positions.Originally, everyone was scrambling for chips below 3000, but now, these snatched chips are simply not enough.

To put it bluntly, the previous situation was a small bottom in a phase, and this time, the intention is to catch a much larger bottom.

The prerequisite for catching a large bottom is that there is a massive outflow of chips at the bottom, which is inherently illogical.

However, there is one situation that can lead to a large outflow of chips at the bottom, which is forcibly extending the cycle to wear down the bottom.

On one hand, as time stretches out, more people will not be able to endure the ordeal and choose to leave the market.

On the other hand, if the price drops too much, there may be a continuous emergence of chips from forced liquidation.

If you want to get as many chips as possible at the bottom, then you can only accumulate little by little, using time to exchange for the quantity of chips.

Some people ask me which I prefer, and I think both situations are.

In simple terms, the capital in this round wants to catch a relatively large bottom, with a lower price, and at the low price, buy more.

As for the issue of this price, whether it is 2800 points, no one can answer this question.After all, we cannot speak on behalf of the large capital that is trying to bottom-fish.

Moreover, it is also temporarily impossible to determine whether they have collected enough chips at below 3000 that they wanted.

After all, if it is really a major bottom, the bottom cycle is usually not too short, it starts with at least 200 trading days, and the cycle of collecting bottom chips is very long.

Everything depends on how much capital wants to bottom-fish at this bottom, and how many of the cut-loss orders need to hand over the chips.

What does the cycle below 3000 points mean for retail investors?

Some people see risks, some people see opportunities, which is the different mentality between those who hold cash and those who hold stocks.

But from the overall environment, those who have money and dare to enter the market to buy, buy, buy, are definitely a minority.

Mentally and economically, it is no longer supported, and those who are optimistic about A-shares have already been fully invested.

In short, even if there is a big bottom, the relationship with retail investors is not much, because there is no money to bottom-fish.But this cannot change what the market itself wants to do, which is to seek new opportunities below 3000 points.

The market's fall below 3000 points must be a reflection of an objective fact.

From a pessimistic perspective.

The market's expectations must have undergone significant changes.

A lot of economic data also indicates that there is a certain deviation between the overall economic development results and the economic expectations at the time.

This is also a main reason why many large funds began to shift from optimism to pessimism.

If viewed from this perspective, the days below 3000 points will not be too short, and there may be a relatively long time cycle.

Because the cycle of economic recovery is slower than expected, and it is reflected in the performance of listed companies and other aspects, it requires a longer cycle.

For retail investors holding positions, it is a painful abyss.

If this cycle below 3000 points is really stretched to more than 200 trading days, that is, nearly one year, it will fluctuate at 2900, 2800, or even 2700, 2600.Because the position is heavily loaded, one can only lie flat, and thus every day is destined to be in torment, with no hope in sight.

From an optimistic perspective.

Stocks have become cheap, and super cheap, with opportunities everywhere.

In the market, those once white horses, even if they are not doing well, are still camels that have not starved to death.

They have gone through a round of mindless speculation, and then a round of mindless selling, returning to the starting point, isn't that a great investment opportunity?

From a valuation perspective, the Shanghai and Shenzhen 300 near 2900 presents a very big opportunity.

The cycle is full of gold, and for many value investors, the more it falls, the better.

Of course, there is a prerequisite, that is, these people still have a lot of money in hand, waiting to bottom out these core assets.

In the stock market, making a lot of money has a prerequisite, that is, the price you buy at must be sufficient.

If the index has been hovering around 3000 points, and 3400 above is a ceiling, then the space is very small.But if it falls to 2800, or even 2600, and then looks at 3400, the space is not small.

Therefore, the optimists are waiting for the fall to create space, looking for better investment opportunities, which is just the opposite of the pessimists.

They believe that the market will sooner or later return to a position above 3000 points, which is beyond doubt, so isn't this a good opportunity to buy now?

What really needs to be done is to control the position well, control the mentality, and then patiently wait and resolutely execute, that's enough.

Investment is always a coexistence of opportunities and risks.

When it rises, think more about the dangers, and when it falls, be more patient.

Emotion can't solve the problem, find the direction and way out.

If you think it will sooner or later return to above 3000 points, then is it an opportunity or a risk now?

Comments