Stock trading is all about focusing on the leading stocks, and the market is all about following the main trend.

More than 90% of stock investors would agree with this statement.

This statement is indeed a secret to stock trading, revealing a truth about it.

Market speculation is ultimately built up by capital.

There is nothing new under the sun; everything is just a cycle repeated over and over again.

The cycle of the capital market is a theme that ignites a main trend, then a bunch of water armies tell stories to a bunch of people, and finally, they lure a large number of people to take over the positions.

Real estate was, banks were, securities firms were, financial technology was, big data was, AR/VR was, later on, big consumption was, medicine was, white liquor was, big white horses were, photovoltaic was, new energy was, cars were, and later, AI was, pre-made dishes were, robots were, and Huawei still is.

All the speculations, in the end, are just stories, without exception.

Make the story more attractive, and then a bunch of people come to speculate, ultimately completing the distribution of chips.

This is a game of capital, and the way to play is actually the same.First, set up the game, open the poker table, and then use information and the rise to attract players to the table to participate.

When the whole market goes crazy for it, the dealer carries the money and leaves, leaving a bunch of retail investors to continue fighting on the poker table.

Retail investors can actually choose not to participate, but the ones that really make money and have good profit effects are the ones in this game.

Because in other games, the number of people will decrease, and the business will become more and more desolate.

So, even if you know that someone will have to take over in the end, smart investors will still choose to join the game.

Because relatively speaking, only in this game will there be more opportunities to make money.

This is why it is said that stock trading must focus on hot spots and catch the leaders.

Including many times, we see some big bull stocks, such as Moutai, which have big bull years, and some years they just don't rise, the principle is the same.

Performance is just a reason to attract funds to the table, the essence is to see how much money recognizes this reason and really gets on the table.

If at the moment, it is not on the wind, no matter how good the performance, it cannot bring the stock price to rise.This is also the paradox of so-called value investing, where capital determines everything.

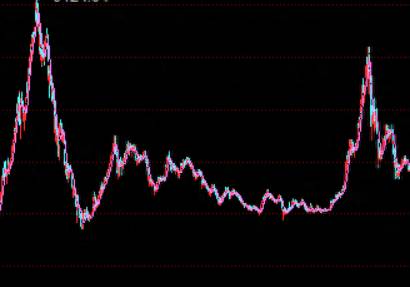

If we look at the results alone, the main trend, also known as the alpha trend, refers to the main line's rise in amplitude, which far exceeds the index's rise during the upward phase of the market.

Some people say that it falls less than the index during a decline, which is actually incorrect.

From a long-term perspective, once the market trend turns, the main line's decline in amplitude must also be greater than that of the index.

The so-called less decline is still within the upward trend of the overall market, where capital embraces the main line sector, so the main line's decline will be less.

In the overall trend of the market, the alpha return rate of the main line is the highest.

The reason for this is the continuous influx of capital and the continuous replenishment of the main line sector, bringing about a phased rise.

If we look at the main line according to this logic, or look for the main line, the problem becomes very clear.The conditions that the main line should possess are also very clear.

Firstly, the general direction of the trend of the times, which facilitates storytelling.

Whether it is a hot topic or the main line, it revolves around the story.

This is the core, which must be firmly remembered.

Those that cannot tell a story are not the real main line.

Some people say that before, when speculating on blue-chip stocks, what story was told.

That was a story of stable growth in performance, a story of core assets whose stock prices would rise in the long term, which is also a story.

The stock market is equivalent to a story, which has always been correct, and the essence of investment is to weave a dream of the future, that's all.

The imagination comes from how the story is told and how many people believe in this story.

Therefore, telling a story should be in line with the general background of the times, and it would be even better if there is some policy background.Secondly, a sufficiently large plate to accommodate a sufficient amount of capital.

This point is the most important, because speculation requires capital, and capital requires capacity.

A plate with a total market value of only tens of billions, how can it be hyped?

Some stocks have a daily turnover of tens of millions, and large capital will not even look at them.

Because once you buy in, the stock price will rise chaotically, and you can't get the chips. When you sell, there is no one to pay attention, and there are few people to take over the plate.

The main line of the market is not a single dealer, and capital is definitely looking for a larger volume, more individual stocks in the direction of the industry plate.

The whole concept should at least be related to hundreds of listed companies, and then expand a bit, at least related to four or five hundred listed companies.

In this way, capital has enough space to move in the individual stocks of the plate, which is convenient for its own advance and retreat.

Third, the leading individual stocks give the market the effect of making money.

The market will definitely set a benchmark, which is a characteristic from ancient times to the present.The dragon head does not fall, and the market will always have room and heat for speculation.

A lot of capital speculates on the dragon head, not to make money, but to set a benchmark, so that the entire sector has the effect of making money.

Even if you can't make it out of the dragon head, you can find corresponding opportunities in other stocks on the main line.

The market needs the effect of making money to attract follow-up capital, otherwise, the final delivery is also a big problem.

Regardless of whether the main force makes money from the dragon head, if the retail investor can grasp the dragon head, they will definitely be able to dig a pot of gold.

Therefore, for the dragon head stock of a main line sector, you need to be brave to grasp it, the dragon head will not easily die, unless the main line is a pseudo main line, and the direction is wrong.

Fourth, there is enough support from the water army to trigger topic speculation.

The hot spot needs not only the stock price to go up, but also a lot of support from the water army and online articles.

Now the efficiency of internet dissemination can attract a large number of people to take over the position, so the water army is indispensable.

Various online big shots, with traffic passwords, go to promote the prospects of a sector.In simple terms, a group of people tell the same story, making it seem more real.

When no one tells the story anymore, the hot spot fades away, and the so-called main line ceases to exist.

Fifth, there is a large-scale "white knight" to facilitate the final retreat.

Don't think that capital only wants to find retail investors to take over; most of the main lines are ultimately taken over by public and private funds.

Capital at the level of tens or hundreds of billions entering the market certainly cannot rely on ordinary retail investors to take over.

The ultimate target of the capital is the take-over by public and private funds.

The reason they can aim in this direction is that public and private funds, as well as some large capital such as insurance funds, do indeed need to allocate in this main line direction.

However, these professional institutions have a cycle from investment planning to decision-making to implementation.

The main force will drive up the price before the cycle, allowing them to take over at a high position, facilitating their own complete retreat.

Therefore, the first round of speculation is the core, the profit effect, and the second round of speculation is the tail, in order to find a "white knight" to take over, for the sake of escaping.You must understand this logic, and the stage of main line speculation must be clear.

When you understand what the real main line is, then the way to quickly lock onto the main line is actually within reach.

The sector must be large enough, the capital entering must be substantial, the leading stocks must rise significantly, and the profit effect must be good enough to be a hot spot and the main line.

Among them, the sector being large enough is really crucial, otherwise, the capital capacity will not be sufficient, and it will not last long.

The capital volume corresponding to the main line is on the scale of hundreds of billions, or even trillions, and some minor sectors will not become hot spots.

Retail investors cannot catch the main line one step ahead of the main force, but if they are sensitive to the market, they can also get on the train quickly.

Reviewing the daily limit-up stocks and the review of capital and sectors are very important.

To make money in this brutal market, the necessary homework is absolutely indispensable.

Comments