The market is currently popular with a saying.

If three consecutive days of rising prices are not enough, then let's have another three consecutive days of rising prices.

This is the rhythm of having already killed the short positions and forcibly pulling up confidence.

But if you are a rational investor, you will find that this is not an increase, but just some compensation for the decline.

First give you a few hard slaps, and then give you a candy, how does this suddenly become a bull market again?

Those who shout about the bull market, is it hasty, or a bit absurd.

As mentioned before, in this economic environment, there may be a "man-made bull market."

It refers to artificially creating policy benefits to increase confidence and drive the market's trend.

As a result, the market feels that there is no space to make a trend, and forcibly kills the index down by another 500 points, from 3200 all the way to 2700.

The first round of policy became an empty shot, and then the second round of policy began.The recent flurry of policy releases is intended to emotionally pave the way for this round of "artificial bull market." The three consecutive days of gains serve as a strong stimulant for everyone, complementing the implementation of policies, including the rhetoric surrounding the value management of state-owned enterprises.

However, these measures do not fundamentally constitute the foundation of a bull market, because the basis of a bull market is not at all about rising prices and "slogans."

The rise in stock prices can be attributed to two main factors: one is called a trend, and the other is called a correction.

Let's talk about the correction first.

Most market movements originate from corrections rather than trends.

There are primarily two aspects that the market needs to correct.

The first aspect is called sentiment.

Sentiment refers to the phenomenon where, after a stock has experienced a significant and continuous decline, it is prone to a sudden surge in the market.The eruption is not about the strength of the rise, but the sentiment of the rise.

Falling every day, no one can bear it, and some people will choose to cut their losses at the bottom.

At this time, market funds will get short-term bloody chips and make a rebound market.

The second point is called valuation.

Valuation repair is even easier to understand, the stock price is cheap, and naturally someone will buy it.

Some sectors are obviously below the normal valuation range, and naturally there will be a repair market.

Just like from 2019 to 2022, bank stocks basically didn't rise much, and the valuation continued to decline.

In 2023, this sector had a more obvious repair, using the high dividend theme to make a round of the market.

Valuation repair is actually also a kind of sentiment repair, which is a self-repair caused by a long-term decline leading to a low valuation.

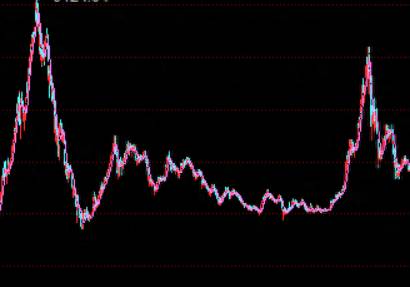

It's like the index was falling before, and the rebound was very weak, and suddenly it accelerated the decline, and then it made a V-shaped reversal in the short term, which is a dual repair of sentiment and valuation.Repair and Trend: The Greatest Difference.

During the repair phase, the market will only move to a reasonable valuation range, and emotions will gradually return to rationality.

However, the trend is completely different.

A trend-based market, also known as a bull market, is irrational, impulsive, and driven by a continuous influx of funds.

Our several bull markets have all been supported by a large influx of capital.

Whether it is a large number of residents opening accounts to enter the market, leveraged funds entering the market, or public mutual funds entering the market, all have brought trend-based capital inflow, pushing up the market.

A trend-based market, in addition to various reform systems, various resounding slogans, and various extremely low valuations, also requires real gold and silver investment, and it must be sustained.

A trend-based market means that the index will not rationally stop within a reasonable range, but will soar and break through the clouds.

Each round of trend-based market, in the end, is because of the capital cut, to pull down the curtain, while accompanied by high valuation, and small shareholders stand guard.

This is the real bull market, but this is also the end of the bull market.Many people do not understand what a bull market is, or have never experienced a true bull market, and therefore do not know where the difference lies between a bull market and the usual rebound market.

This leads to the situation where, as soon as there is an increase, they mistakenly believe that the bull market is coming.

Once there is a decline, it breaks their illusion of a bull market, and this goes on and on.

So, if you can't understand the market trend, it's easy to fall into the anxiety of whether the bull market is coming or not, and you don't know whether to sell or buy when the price rises.

Here are a few tips to explain the general logic of a bull market.

As long as you can understand the following points, it is relatively easy to distinguish whether it is a bull market or not.

1. Is there a large amount of capital entering the market?

A large amount of capital entering the market can create a bull market.

A large amount of capital is definitely not as simple as retail investors entering the market.At the national level, guiding large capital into the market, whether it is domestic capital, foreign capital, or other funds entering the stock market.

This introduction must be long-term and effective in order to bring in truly incremental capital.

The scale should be at least more than 5% of the market value.

Now with a market of 80 trillion, at least 4 trillion of capital must enter the market to be considered a bull market.

In the bull market of 2015, the highest daily transaction amount could reach 2.5 trillion, and small-scale funds definitely do not have this ability.

In contrast, the current market does not have many transactions of a trillion, and the scale of funds introduced is only at the level of tens of billions, which is obviously still waiting for policy guidance to bring funds into the market.

2. How long has it been since the last bull market?

The cycle of a bull market is very long, 7-8 years per round, or even longer.

If a bull market was just experienced three years ago, it is definitely not in a new bull market cycle now.

If there is a large-scale doubling opportunity every three years, then who would still go to work, everyone would just wait for the bull market.The bull market cycle is an economic cycle, and it is a major one. A true bull market often arrives late.

3. Has the bottom been long enough?

Another characteristic of a bull market is that it needs a long period of bottom building before it starts.

It can be as short as nearly a year or as long as two to three years.

This is because the real behind-the-scenes main force needs a large number of bottom chips, and they need to be cleaned very thoroughly.

What is a V-shaped bottom, it does not conform to the cycle law of the bull market.

At the monthly line level, there is a cycle of a big bottom, which conforms to this cycle, and it is possible to give birth to a bull market.

4. Is the market sentiment very low?

The origin of the bull market, like the night of dawn, must be quiet.

The market in these two years cannot give birth to a bull market because it is very noisy.Good emotions, bad emotions, have been fermenting, and there has never been a quiet time for the bull market.

A bull market must occur when no one is interested, not in the midst of everyone's cursing.

The market's emotions cannot be anger, nor should they be panic, but rather the kind that nourishes things silently and imperceptibly.

5. Can policies and the overall economic environment support it?

A bull market requires support from the overall economic environment, and not just any environment can give rise to a bull market.

It seems that GDP is growing every year, but in fact, the economy is not smooth sailing.

Whether the economy is good or not will ultimately fall on the performance of listed companies. If listed companies do not make money, there can be no bull market.

The overall economic environment mainly depends on monetary policy, social financing data, corresponding consumer price indices, manufacturing indices, and so on.

External factors such as foreign exchange, war situations, and relations between China and the United States and other countries all determine the overall environment.

The overall environment should be mild, the currency should be mild, and economic development should be smooth, making it easier for a bull market to emerge.On the contrary, a continuous decline is also a common state, after all, a large amount of capital will be drained from the stock market. In a market without incremental funds, it is difficult to rise.

In summary, a bull market will not come easily, because a bull market is an opportunity to create wealth. How can there be opportunities to create wealth frequently?

The correct way to view the market, especially the corrective market, is to be good at waiting for good opportunities.

Comments