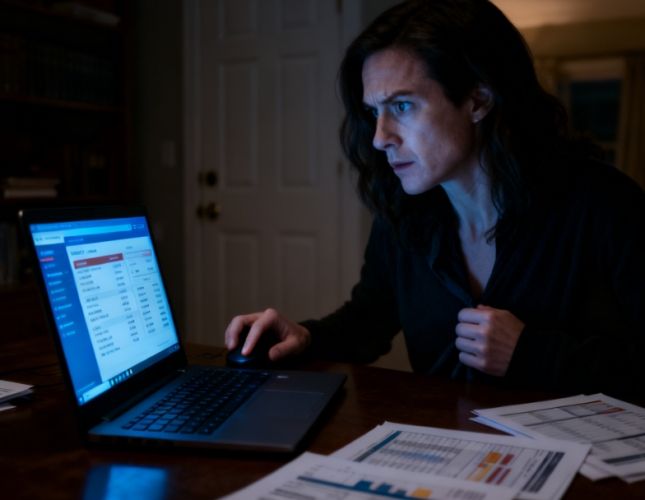

Yesterday, I saw a message from a retail investor that was a bit heartbreaking.

"I love my country very much, but why doesn't the A-share market love us? Just because we are better off than ordinary people and have money to invest, should we be the ones to be 'harvested' like leeks?"

This sentence is the voice of countless stock investors.

How many retail investors hope that the A-share market, which is like a 'scumbag', can take responsibility for themselves.

They come with hope, but feel like they have fallen into a bottomless pit.

In fact, everyone's expectations are good, but unfortunately, the stock market will not be responsible for anyone, because this is the capital market.

The capital market itself is bloody, it is about 'harvesting', not about giving money to everyone for charity.

Many people may have heard stories about the capital market, but they always feel that they are just stories.

More often, people yearn for those stories of stock market gods, rather than those tragic cases of bankruptcy and jumping off buildings.

Capital = plunder, this sentence is not false at all, because capital is thoroughly profit-seeking.Capital does not show mercy to anyone; its goal is to make money.

In a bull market, making money involves playing with retail investors, as there is an influx of funds to be harvested like leeks.

In a bear market, making money is about specifically cutting retail investors, as there are no other funds to be harvested.

The concept of responsibility is completely non-existent.

Thus, in a bear market, retail investors place their hopes on policies, hoping that funds will enter the market to rescue it.

But they forget one thing.

That is, the funds are still capital, not philanthropists.

In other words, the funds for market rescue are not here to provide welfare to retail investors; they stabilize the market to make money as well.

This is also why pension funds can always accurately bottom-fish, because they are also here to make money.

When the index warms up, these capitals also need to take the money and leave, not like retail investors, filling the money into the pit.What's even more critical is that, after a long period of shouting, this time it seems that even the capital is reluctant to get involved.

It's unclear whether it's because there are no more "leeks" to be cut in the market, or they are showing mercy and don't want to enter the market to cut leeks, or perhaps they feel that this position might still be risky, and entering the market might turn themselves into leeks.

When a group of people waving sickles are all in a state of watching and waiting, it's not hard to explain why the stock market has been falling continuously this year.

In fact, similar situations have happened many times, but most retail investors have not experienced them.

From 2001 to 2005, and from 2010 to 2014, there were two long bear markets, and there were also such desperate times.

It's just that the internet was not as developed at that time, and the transmission of emotions did not easily resonate as it does now.

In the long bear market, the main ways to resolve it are divided into three aspects.

The first is major institutional reform.

In 2004, it was the reform of the state-owned shareholding system, which promoted significant changes in the market.

In 2014, it was the mixed reform, mergers and acquisitions, which promoted significant changes in the market.Significant reforms require a catalyst, and the stock market acts as that catalyst. At that time, the reform of state ownership was ignored by everyone, but the market aggressively speculated on it, to the point where capital could not afford to ignore it. Instead, it chose to look for targets that might be reformed for speculation, and the market took off.

When speculating on mergers and acquisitions, the market provided a direct example of the merger of the North and South Railways, which saw the stock price increase tenfold, revitalizing the entire M&A market and leading to another round of frenzied speculation.

It is often said that the stock market is a policy market, which refers to the capital opportunities brought about by major reforms, driving the market's performance.

The second aspect is the market's natural recovery.

What is natural recovery? It is the recovery from ups and downs.

When the market rises too much, it will naturally fall, and when it falls too much, it will naturally rise.

The market will not always let investors lose money; occasionally, it will also provide a sweet treat in desperate situations.

Even if the bull market is short and the bear market is long, in a large cycle of 6-7 years, there will still be a bull market.

The market will naturally recover during the decline because when the price falls to a certain level, it will become cheap, and naturally, capital will come to buy.

In other words, risks will eventually be naturally resolved because when the price falls to a certain position, it can no longer fall.No one buys at 3000 points, surely someone will buy at 2500, if not, then at 2000 points, 1500 points, someone will buy.

Repair is an instinct and a natural law, but the cycle of repair is very long, and the process is also very painful.

Most investors can't stand the experience of a bear market for 3-5 years, and naturally they can't wait for natural repair.

The third is the comeback of incremental capital.

Incremental capital comes only once every few years, not always available.

Even retail investors entering the market have a rhythm, and there are many times when there are no retail investors.

The last round of incremental capital mainly came from public funds, and now the fundraising volume of public funds has fallen to an ice point.

But incremental capital will not be absent, they are just looking for a good buying point and policy support.

The incremental capital of professional investment institutions is very smart, and the increase in state-owned capital is a sure hit in bottom fishing.

Incremental capital needs a reasonable price, with the approval of policies, when it should have, it will actually have.There is also a portion of incremental funds that come from the market's vast money-making effect. If the market can make money, why worry about the lack of incremental funds?

No one will be responsible for your wallet; the only one who can be responsible is yourself.

For investors, it is essential to remember one thing: you always have the right to choose.

You can choose to exit, choose to wait and see, choose to lie flat, or choose to gamble.

At any time, remember that the right to choose is always in your hands.

Capital will only try to exploit you, and you must find ways to deal with the capital market from the dense patterns.

There are five "don'ts" that are more core.

First, do not believe in bottom-fishing.

The A-share market has never had a bottom, and most retail investors perish in the attempt to bottom-fish.Do not try to catch the bottom, because there will be no results.

Never believe that catching the bottom can make money, because catching the bottom is not something retail investors do.

When it was at 3200, everyone said it was an opportunity, but then it went to 3100, 3000, and 2900, where is the bottom?

Every time the market hits bottom, it is much lower than the rational judgment of the bottom position.

Secondly, do not take the initiative to go all-in.

Do not actively choose to go all-in, retail investors simply cannot control an all-in position.

Most retail investors who like to go all-in are basically losing money, with only a few able to make a profit.

It makes sense to think about it, in a market with short bull and long bear, being all-in most of the time will be a losing proposition, this is the rule.

Keeping some positions not only reduces risk, but mainly can maintain a good mentality, which is beneficial to trading.

Thirdly, do not choose to lie flat.There are also some retail investors who lose money due to self-abandonment.

That is, they realize they have bought the wrong stock, but choose to lie flat in response.

Mistakes must be admitted, because if you don't admit your mistakes, you may have to bear a greater loss.

Never choose to lie flat, because there is no way out when you lie flat, and you have given up the initiative, how can you make money in the stock market.

Fourth, do not trade frequently.

For high-frequency trading, the vast majority of retail investors are also unable to control it.

You can ask those short-term trading experts, are they really trading frequently? In fact, they are not.

They are just good at seizing short-term opportunities, but they are not busy trading every day, frequently trading.

Steady, accurate and ruthless, is always the principle of trading, there is no more than this.

Fifth, do not listen to the news.Any publicly available information, the value it brings, is actually reflected in the market.

Large capital has already laid out a step ahead of retail investors, and when retail investors enter, it's the time to get trapped.

Whether it's gossip or public information, retail investors are always the last to know, and the information has lost much of its value.

Paying for public information is a very foolish thing, because public information is designed to make everyone a "plate receiver."

The way to make money in the stock market is actually written in the history of A-shares, constantly repeating.

There are not so many new things in the financial circle, it's just the control of capital over human nature.

Think carefully, after investing for so long, what have you done right and what have you done wrong, follow the rules, don't do as you please, everything will naturally have an answer.

Comments