After much thought, in fact, a more peaceful title has already been chosen.

Many people say that the market has eroded everyone's confidence.

Once confidence is shattered, it is very difficult to regain, which means that even if the market rises, the retail investors will no longer participate.

I have seen many comments in the comment section.

It is said that the index is being forcefully pulled up, but the retail investors are not following, and without substantial good news, the retail investors are not following, and confidence is already gone, the retail investors are not following.

What everyone means is that even if the market rises now, retail investors will no longer buy.

In the past two days, a series of good news has been released, and it seems that confidence is starting to be rebuilt.

It is said that confidence is gold, worth a thousand gold, but confidence is shit, worthless.

The capital market is like a battlefield, betrayal is just a moment, and the situation between bulls and bears changes in an instant.

It is like the retail investors who are now fully invested and lying flat, always waiting for the market to save, always harboring hope, or rather, taking a chance.Those who are now waiting with empty positions are always looking down, waiting for the market to break through 2600 before considering entering.

But the main force of capital is different; it may be the one that short-sells today, and it will also be the one that picks up the chips at the bottom tomorrow.

It doesn't care about your confidence; what it wants is to break your psychological defense and then get the bloodied chips.

Similarly, when the market rises, it wants to make your mentality soar, and then let you be trapped at the top of the mountain, becoming a super "plate catcher" (a term used to describe someone who buys at the peak of the market).

There are no philanthropists in the stock market; everyone comes with a sickle.

So-called rescue funds are just a glimmer of hope given in times of despair, but in fact, they are also coming for the cheap chips, for the opportunity to make money, where is there any good intention?

Why is confidence considered as dog feces?

You can imagine what dog feces look like, it is something that is abandoned and attracts flies.

In the stock market, confidence is also abandoned and left unattended.How could capital possibly consider the confidence of retail investors? It's their ferocious face to harvest when it's time to harvest.

Firstly, confidence can be trampled upon.

What does it mean to trample upon confidence? When the market falls wantonly, it is trampling on your confidence.

When investing in stocks, most people will have a belief in holding shares, otherwise, they can't hold onto the stocks.

What the main force needs to do is to rub the belief in holding shares repeatedly, making you end up buying high and selling low.

Of course, it's not that always holding is right, sometimes it's also wrong.

But you will find a characteristic, that is, in the bottom area, it is easy to appear a panic selling situation.

It is to give you a positive line, and then a series of large negative lines, to kill the stock price down, which is the biggest way to trample on confidence.

The green numbers in the account are the confidence that has been trampled on the ground.

The word "trample" represents being pressed to the ground and unable to move, just like many people are deeply trapped on the floor.Building up psychological strength every day is not as effective as a single bearish candlestick that plunges downwards.

Secondly, confidence is worth nothing.

Why is confidence worth nothing? It is because confidence is never needed in stock trading.

What is needed in stock trading is real money, not slogans.

Shouting slogans may seem to show confidence, but on the battlefield, without funds, there is nothing.

Confidence cannot be exchanged for money. Many retail investors hold onto their confidence, clutching their shares, even if they do not sell a single share, it cannot prevent the decline.

This is because those who hold the shares are actually the bears, while those who buy with money are the bulls.

Confidence will gradually be eroded in the decline, because confidence cannot prevent the decline, nor can it bring about the rise of the stock.

What does the capital market talk about confidence? The major forces are waiting behind the scenes for the collapse of confidence, so as to pick up cheap shares.

Those who talk to you about confidence all day long are really worth nothing.When your confidence is shattered, it is right to tell you that chips are important.

Thirdly, confidence is human nature.

To put it bluntly, a dog cannot change its habit of eating feces, which is one of the essences of human nature.

Casinos are not afraid of people losing money, because there will always be people coming, and there will always be a small number of people who can win money.

The essence of human nature is greed, and what human nature is best at is following.

When the market is bad, there is no confidence, and everyone is crying and shouting.

When the stock market rises, no one enters at first, and then it continues to rise, and it still rises?

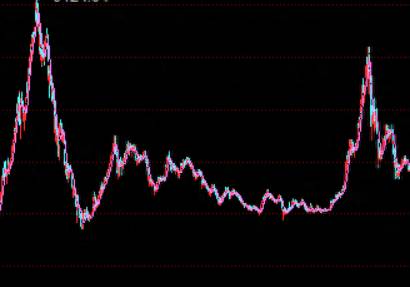

Look at the time when it was 998, wasn't it full of wailing, and what was it like when it reached 6124 later?

Look at the time when it was 1849, wasn't it a collapse of confidence, and what was it like when it reached 5178?

When the market comes to 3000, 3500, or even 4000 again, will there be no confidence? When the news is overwhelming, shouting more, retail investors will naturally enter the market.Confidence comes from the effect of making money, not from any market system, it has nothing to do with it.

No matter how many favorable factors there are, nothing can restore confidence as quickly as an increase in prices.

If you want to play, just let go of the so-called confidence and find a way out quickly. If you don't want to play, find an opportunity to leave the market as soon as possible.

Facing this brutal market, following the market's emotions to find opportunities is actually very promising.

However, controlling your position and managing your emotions are very important.

The fatal mistake made by the vast majority of investors is to link their positions with their own predictions.

When your position becomes heavier and heavier, interests are easy to blind your eyes, making you overly optimistic.

Confidence and your buying actions are very consistent actions, and it is also the key to the problem.

Therefore, the real way out is how to decouple confidence and execution, and not to use subjective judgments to predict the rise and fall of the market.The following three points are very important.

1. View the market objectively. A decline is always a release of risk, while an increase is a buildup of risk.

A significant drop will inevitably lead to an increase, and a significant increase will inevitably lead to a decline.

The risk of an upward trend is constantly accumulating, and this is something to understand.

Similarly, the longer the decline lasts, the smaller the risk becomes. Why become more and more panicked?

Seeing through the essence, emotions are just confusing your foundation when the market is at a low point.

You've already taken the hit on the hundreds of points above, and there's no need to gamble to avoid the last 100 or 200 points of decline.

2. When the market sentiment is very low, be brave enough to buy, but don't go all-in trying to bottom-fish.

Low market sentiment indicates that opportunities are slowly coming.

At this time, be brave enough to buy, but the posture of buying must be correct.Do not always think that you can catch the bottom; it is essential to buy in batches. The gambling mentality of going all-in is the one that is wrong.

Many times, buying in batches at lower levels turns out to be the right decision when looking back.

So, emotions may not take effect in the short term, but they are definitely right in the long run.

3. When the market sentiment is high, it is important to remain calm and secure your gains when necessary.

The reason many people do not make money is not that they have never made money, but that they did not put the money in their pockets in time.

When the market is rising, you should know how to secure your gains, whether it is a lot of money or a little money. Only the money in your pocket is the real money.

Especially when the market sentiment is high, you must know how to sell, dare to sell, and be willing to take a break.

Do not expect to make money every day; that is an absolute impossibility, let alone in the A-share market where bulls are short and bears are long.

Do not trade stocks with confidence or willpower; more often, step out and look at the market.

Do not let yourself be overwhelmed by news every day. The most important thing is to see the current market sentiment clearly.What rescue market policies, what bearish raids, in the end, it's all a game of chess played by the capital itself.

Looking back, foreign capital has already been sold out, isn't the collapse of the market still a trick we played ourselves, right?

What confidence or no confidence, all are fake, only the trend and profit and loss, will not deceive people.

Comments