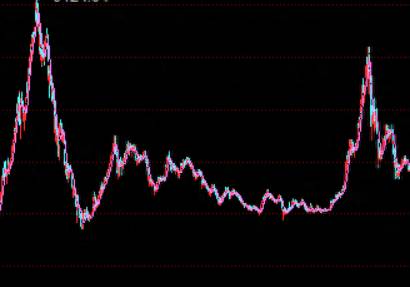

Have you noticed a sign that the index is fluctuating more and more within the market?

The frequency of red and green interspersed is obviously much more than before, no longer stagnant.

But after a day of observation, it is found that the actual trading volume is not large, and the feeling within the market and the actual situation are far apart.

At this stage, many retail investors have poor resistance to pressure and are particularly sensitive to red and green plates.

Especially, they are also very sensitive to the number of rising and falling stocks.

In fact, the market has already seen many times the situation of 4,000 stocks waiting to rise, turning into 2,000 stocks waiting to rise, and then back to 4,000 stocks waiting to rise.

That is, a trading day needs to go through multiple emotional fluctuations and switches.

At the same time, it will also be found that the market funds will appear high-frequency and fast sector rotation phenomenon.

All these point to the fact that the funds are entering at a low level.

Low absorption means that the fund position has not been completed, and the bull and bear have not yet been reversed."Low absorption" means that capital does not have the initiative to buy at high prices, and is unwilling to enter the market at high levels.

Low absorption implies that there may be even lower points, but capital is afraid that there will not be enough chips and is laying out in advance.

Low absorption means that the bottom is not far away, and a stop and rebound trend may appear at any time.

Some people will ask, if there is a shock in the market, is it possible that it is a platform, and further downward breakage?

It is entirely possible.

But it depends on the specific situation, what exactly it is.

If the index continues to fluctuate in the market, with various sectors rotating, and signs of selling at high levels appear, it is a clear sign of a platform breakage.

That is to say, capital uses rapid rotation to cover the main force to escape, and completes the sale of each sector in the shock.

This situation usually occurs after the index reaches a stage top, or when it falls to the first stop platform.In general, the strategy is to take advantage of market fluctuations to sell when the index is at a high level, luring in more buyers while mostly retreating.

However, if after a continuous decline, the market starts to fluctuate at the bottom, it must be that some capital is tentatively entering the market.

If the frequency of fluctuations is particularly high, it actually indicates an intention to build a bottom.

When a bottom is formed and the index continues to fall, it is commonly referred to as a "divergence at the bottom."

That is to say, if there is a clear phase of bottom building, but the index continues to decline, it is a process of continuously increasing positions.

For retail investors, bottom-fishing is not something that can be achieved overnight, but a process of building positions in batches. Market signals can only indicate that the bottom is not far away, but they cannot represent that this is the bottom.

Therefore, when observing the market, it is important to understand this overarching principle and not to impulsively buy, buy, buy.

Let's discuss a few very important points.

The index has shown a pattern of bottom fluctuation, at this time it is necessary to prioritize judging the main line, that is, the sector that may not have a second bottoming out.Generally speaking, when there is a sharp fluctuation in the index within the plate, it is often brought about by the movement of the plate.

In other words, in fact, some funds have already obviously intervened in certain plates, and these plates may start before the overall index.

On the left side of the bottom, there are usually only two types of plates that can survive.

The first type is the main line of the new market.

Some people may be curious, does the capital know the main line of the new round of the market in advance?

If the capital does not know in advance, how to lay out at the bottom.

When the market turns to the right and does a lot of long, how to get the bottom chips.

Therefore, the capital will start to lay out on the left side of the market, which is very important.

At the end of the index decline, the stage where it is not easy to fall, those stocks that can rise against the trend are the main line of the market.

Some sub-plates, if there is a leader that can continue to rise, are the standard signal of capital entering against the trend.Capital entering the market to bottom-fish must have a direction and signs.

They are not fools; to enter against the trend and still make a profit, there must be an element of foresight involved.

The second category is the defensive sector.

In the past, high dividend sectors, consumer sectors, and resource sectors were considered defensive.

Because the certainty of these sectors is relatively stronger.

But now, with unstable commodity prices and insufficient consumer confidence, the defensive sectors are only left with sectors such as banks, coal, and dividends.

These sectors have become the concentration camp for capital to avoid risks.

However, capital will not always avoid risks, so when the market starts to slowly turn to the right side, these sectors will actually usher in a round of catch-up falls, because the capital needs to come out.

When the capital comes out, the bottom has already been clear.

As for why the market fluctuates more intensely, it is not far from the bottom, because the capital has already started to lurk in these sectors.When determining the bottom, we need to pay attention to the following points which are already quite clear.

1. Whether the trading volume has shrunk and there is a clear fluctuation.

Fluctuation also has a prerequisite, that is, the trading volume must be reduced.

Looking at the red and green in the market, but the trading volume just can't go up.

The reason for this phenomenon is that there is not much game at a relatively low point.

Why funds repeatedly fluctuate and why they rotate is to sweep the chips in the direction they are optimistic about.

If it is a fluctuation with an increase in volume, it represents that the funds have too much divergence, which is not a signal for a short-term stop.

2. Whether there is a sector with obvious signs of capital intervention.

Bottom-fishing must have a direction, and the main point of short-term stop is to see if the funds have this direction.

So, whether it is the emergence of a concept stock leader or a sector leader, it is a clear direction.Only when this high-standard leading stock appears, allowing the market to feel the importance of direction, does it represent the clear intervention of funds.

Direction is a guide, not just a simple matter of capital hedging, but the funds have to treat it as the main line for speculation.

3. How common is the situation of more red than green, and is the bottom-fishing in the capital plate obvious?

If you have carefully studied various bottom patterns, you will find that more red than green is an important signal of the bottom.

There are many fluctuations within the plate, and at the same time, the situation of more red than green in the long position is a clear sign of the bottom coming.

Because, the funds need to lay out at the bottom, and they will not do it all at once, they will deliberately suppress the stock price.

Rise for a few days, then fall for a few days to bring the stock price back, making many people think that the market bottom has not arrived, and they dare not bottom-fish.

But they are every day, every minute, secretly absorbing chips, ensuring that they have enough chips in their hands.

Without chips, the market will not start, because smart money never likes to give others a lift.

It is said that the bottom is a very complex process, because in addition to the capital side, there are policies, and some impacts of the macro economy.The signal of a short-term halt in the decline can still be detected within the subtle clues of the market.

The last point is that everyone should really calm their mindset, as it is right around the corner.

Comments