Every time the market falls, it is essentially a chorus of lamentations.

But every time it rises, it is not a chorus of cheers, but a mix of joy for some and sorrow for others.

This time is no exception, as the Shanghai Composite Index soars, other sector indices continue to plummet uncontrollably.

How to grasp the structured market, and the sectors that are still falling now, are they opportunities or risks?

As the saying goes, a thought can be heaven, a thought can be hell.

Should we exchange those seemingly hopeless sectors for the main force sectors of this round of the market?

Should we switch from sectors like pharmaceuticals and semiconductors, which no one wants and see no opportunities in, to mainstream varieties such as state-owned enterprises, high dividend stocks, big finance, and real estate?

Today, we mainly talk about the sectors that continue to release bad news, whether to stay or go.

The sectors that are mainly mentioned by everyone now are as follows.Photovoltaic, new energy, pharmaceuticals, and semiconductors are all sectors that saw a decline in performance in 2023, especially in the second half of the year.

The actual performance of these sectors was significantly different from the market expectations beforehand.

Among them, photovoltaic and new energy experienced a sharp decline throughout 2023.

While semiconductors and pharmaceuticals had good performance in August to October, they plummeted in January 2024.

The semiconductors plummeted by 16% in January, and innovative drugs in the pharmaceutical sector also plummeted by 16% in January.

The annual decline of semiconductors in 2023 was only 7%, and the annual decline of pharmaceuticals last year was only 12%, which did not catch up with the decline in January alone.

The concentrated release of performance is a clear bearish factor, coupled with various sanctions, which are expected bearish factors, as well as various small compositions, causing people to be panic-stricken.

If all of this happened at the beginning of January, then the decline and the news actually match.

The key issue is that at the beginning of January, these sectors started to decline without reason, and recently they have even created panic and killed the market, which is a bit different.

Here, two pieces of information are clearly conveyed.Firstly, the accelerated decline creates panic-induced indiscriminate selling.

From a capital perspective, these sectors are heavily invested in by funds. It is important to note that the positions of equity-type funds are now over 90%. This means that funds have little money to replenish their positions, and it is only possible for indiscriminate selling to occur, leaving only the scenario of fund stampede.

In January, the decline in these sectors, including the driven decline of the Science and Technology Innovation Board and the Growth Enterprise Market, was caused by the fund stampede. This situation will not last forever, as there is an emotional limit to indiscriminate selling.

Once the critical value is reached, there will be a retaliatory rebound.

Secondly, the "shoes drop," and the annual report bad news is concentratedly released.

According to the current requirements, by January 31st, it is necessary to disclose the performance expectations of the annual report in a concentrated manner. Of course, this disclosure is mainly for the annual report with a significant increase, decrease, or turnaround in performance expectations.In this context, "pre-decrease" refers to the situation where the performance decline is 50%, and it is necessary to disclose this information.

That is, before the end of January, those stocks with poor performance are required to give advance notice.

Those that do not give advance notice will not have too poor performance, and can delay the disclosure of the annual report until the end of April.

This is equivalent to making full preparations for the market conditions in February, March, and April after January.

Of course, in April, attention should also be paid to the concentrated disclosure of the first quarter report.

In short, the performance of the bear market will be released in a short period of time, but after the release is completed, there will be no major performance of the bear market for two or three months.

The trend in January, the sharp drop in the sector index, has already told us in reality that on the one hand, we need to reduce expectations, and on the other hand, it has the meaning of the bear market being exhausted.

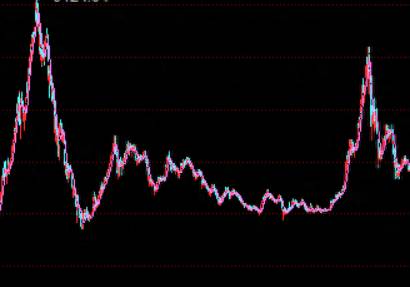

Here, we can actually review an issue, that is, the bottoming form of the Shanghai Stock Exchange Index.

On January 17th, the Shanghai Stock Exchange Index, which was originally calm and building a platform, suddenly experienced a large area of decline.

The closing price was at the lowest point, with a decline of 2.09%, and there was a large area of multiple kills at the bottom.On January 18th, the index further plummeted to 2,760 points, then sharply rebounded back to 2,845 points, forming a deep V-shape.

On January 19th, the index fluctuated throughout the day, slightly falling by 0.47%.

On January 22nd, the index once again faced a moment of mutual killing, plummeting by 2.68%, with the lowest drop to 2,735 points, and the maximum drop of the day was nearly 100 points.

On January 23rd, the index set a new low of 2,724 points during the trading session, and then the index stabilized.

On January 24th, the index opened high and closed low, once again falling to 2,743 points during the session, then violently rebounded, closing at 2,820 points, recovering the lost ground.

In fact, during these six days, the bottom has basically been confirmed as 2,724.

This is a clear round of using the mutual killing drama, taking over the passive closing positions, and then turning to do more, while building the bottom K-line pattern, which also exposes the true intentions of the main force.

When the market is in a bearish trend or a sideways trend, use the psychology of fear and the advantage of the closing line to create panic.

The index has staged a good play of bottom collapse, with a large number of blood-stained chips pouring out.

After the funds get these cheap chips at the bottom, it will be very easy to start the market.Whether it's establishing a position or replenishing a position, once the bottom chips are locked, the probability of making money is very high.

But what would happen if there is no panic and you can't get the bottom chips?

If the main force doesn't have absolutely cheap chips, they will be very hesitant when making the market, and the selling pressure will be very large.

Therefore, you will find three points.

1. To have a significant rise, there must be a significant fall.

There is a sharp rise behind the sharp fall.

It's like a spring, you have to press it down hard to bounce higher.

Those platforms that build the bottom, when they finally rise, the explosive power is also very weak.

2. The bad news at the bottom is the best way to deceive the chips.

The fall of many stocks ends with the exhaustion of bad news.When there is a significant drop at the bottom, keep a close and watchful eye.

Once the structure appears at the bottom, or there is a medium to large positive line, then the opportunity will come.

3. There is no need for a reason for the rise, everything you see is an illusion.

The rise of a stock does not need a reason, even if the situation is very bad, as long as it wants to rise, it can rise.

So, from an emotional point of view, if there is a continuous panic selling at the bottom, the counter-attack of emotions will come.

All you see is illusory, it's all the main capital that lets you see what it wants you to see.

Risk and opportunity coexist, which is known to everyone.

But many people don't know that investing is to find stocks with smaller risks and greater opportunities.

The release of risk and the exhaustion of bad news is one of them.Additionally, it is necessary to assess whether there are opportunities to make a profit based on the actual performance or valuation.

When the stock price falls, do not panic too much, because the lower it falls, the cheaper it becomes, and the more valuable it is.

Do not always mix subjective intentions, because a mistake in a moment may affect the decision itself.

As long as you understand that investing is a game of buying low and selling high, you will understand the mystery behind it.

Comments